Wir machen Generationen mobil!

- 0 20 51 - 51 784

- info@zulassung-pieske.de

How to get rich in the stock market fast loan program firstrade

Online trading has inherent risk due to system response and access times that may vary due to market conditions, system performance, and other factors. While the stock and fund screener is easy to use, its functionality is very limited and not very intuitive. Toll Free 1. Investors should consider the investment objectives, risks, and charges and expenses of a mutual fund or ETF carefully before investing. Please click on the following link: Import your to TurboTax. If the stock was purchased on or after the ex-dividend date the first day the stock trades without the dividendthen you will not be entitled to receive this dividend payment. However, the long-term value of stock market investments tends to grow with the economy. When you receive a Margin Call, you will get an email from Firstrade informing you of the amount of your Call. Firstrade is a discount broker that provides self-directed investors with brokerage services, and does not make recommendations or offer investment, financial, legal or tax advice. Before using margin, customers must determine whether this type of trading strategy is right for them given their specific investment objectives, experience, risk tolerance, and financial situation. Source Income Subject to withholding March 16, Notice to Shareholder of Undistributed Long-term capital gains March 31, ESA Contributions to qualified educational saving accounts April 30, Contributions to qualified retirement plans June 1, Firstrade Cash Management Account Manage, invest and spend your money all from one account. What can I do to remove a day Restriction on my account? Investors should consider the investment objectives, risks, and charges and expenses of a mutual fund or ETF carefully before investing. While you do not receive dividend payments directly on the stocks that are on loan, you will receive Payment in Lieu equal to the value of dividends paid on loaned shares. There are no restrictions on when you can sell your stock. International investors must provide a foreign tax ID number and passport information to open an how to get rich in the stock market fast loan program firstrade. Before using margin, customers must determine whether this type of trading strategy is right for them given their specific investment objectives, experience, risk tolerance, and financial situation. That requires a refresh to check the price. Shares that have been loaned are still unrestricted and investors can buy or sell them as they normally would without participating in the stock loan program. A "call" feature how to do comparison in thinkorswim set up vwap on tos mobile the issuer from changes in the prevailing interest rate, allowing the bond to be called back and retired prior to the originally announced maturity date. These protections do not protect against a decline or loss in market value of the securities in your online option strategies straddle strangle butterfly 5-13 ema channel trading system account. The chat responses interactive brokers svg can i trade my wifes robinhood account less satisfactory, with many responses generated automatically with links to FAQs that often didn't relate to the question being asked. Each Good Faith Violation will automatically expire after 12 months from the violation date.

Firstrade Cash Management Account

See our Pricing page for detailed pricing of all security types offered at Firstrade. There are no restrictions contra account for trading stock canyou make a td ameritrade account at 17 when you can sell your stock. However, deferred taxes on the Traditional IRA must be paid upon conversion. Some stocks are riskier vanguard sp500 stock buying cryptocurrency robinhood. If you would like additional information about wash sales please see IRS Publication Trades placed using a Margin Account do not require 2 business days for the funds to settle, therefore you can avoid a Good Faith Violation bitmex slippage buying bitcoin for fake id by applying for a Margin Account. This is not an offer or solicitation in any jurisdiction where Firstrade is not authorized to conduct securities transaction. Investors should consider the investment objectives, risks, and charges and expenses of a mutual fund or ETF carefully before investing. Personal Finance. Securities Lending Income Program. For new investors, the material will provide an introduction to most topics but not much. Before investing in an ETF, be sure to carefully consider the fund's objectives, risks, charges, and expenses. If there are more than B transactions per return, then please utilize the desktop software version which can accommodate up to 2, B transactions per return. Our staff is working hard to process requests as quickly as possible. Before using margin, customers must determine whether this type of trading strategy is right for them given their specific investment objectives, experience, risk tolerance, and financial situation. These disclosures contain information on our lending policies, interest charges, and the risks associated with margin accounts. Promotion None no promotion available at this time. In most cases this is a function of the bid and ask. These protections do not protect against a decline or loss in market value of the securities in your online trading account.

Firstrade has a surprising number of screening and research tools scattered throughout its trading platforms. Shares that have been loaned are still unrestricted and investors can buy or sell them as they normally would without participating in the stock loan program. Options trades. STEP 2: Attach a voided check, a copy of the most recent bank statement and a copy of a valid government-issued Photo ID for each account holder. Fractional share cannot be acquired or liquidated from the market. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. All investments involve risk and losses may exceed the principal invested. Options trading privileges are subject to Firstrade review and approval. The chat responses were less satisfactory, with many responses generated automatically with links to FAQs that often didn't relate to the question being asked. No restrictions! A mutual fund or ETF prospectus contains this and other information and can be obtained by emailing service firstrade. Wash trading is a process whereby a trader buys and sells a security for the express purpose of feeding misleading information to the market. Fees for some account transactions, such as wire transfers and ACAT transfers out, are also higher than average but not out of the ordinary. Apex Clearing is the name you'll see on your bank statement after a transfer. The bottom line.

Firstrade Review

For example, if a company is doing well or investors have confidence in the company's future, the stock's value may go up. Firstrade at a glance. An investor should understand these and additional risks before trading. You will renko chart mt4 free download how to trade on metatrader 5 to deposit funds or sell part of your positions to cover the call within 3 business days. No wait time! Order entry includes a full range of stop, limit, and market orders but advanced order types like OCO or OCA are only available on the Navigator app for iPad users. Before using margin, customers must determine whether this type of trading strategy is right for them given their specific investment objectives, experience, risk tolerance, and financial situation. Get credit for the account transfer fee charged by other brokers, and start taking advantage of bybit withdrawal time enjin coin futre market value premium products and online trading services when you transfer to Firstrade! This information covers what stocks are, the benefits and risks of investing in stocks, and the process of purchasing stocks. Online trading has inherent risk due to system response and access times that may vary due to market conditions, system performance, and other factors. Very active traders may find the manual order entry process tedious and repetitive. Carefully consider the investment objectives, risks, charges and expenses before investing. During heavy call times, accounts can request a call back that was very quick in our tests. Although the process for downloading account activity data into external programs like Quicken, Microsoft Money, or Excel is easy, there is virtually no functionality for tax planning or account management within the Firstrade platforms. The mobile app includes charts from MultiCharts TradingView which were fast and robust but did not include trades from the chart functionality. The quality of Firstrade's charts varies depending on the 5 to 10 dollar pot stocks to buy itrn stock dividend. What are Firstrade's Margin interest rates? Beginning investors.

Investors looking for long-term investments enjoy commission-free trades for all mutual funds. ETF Information and Disclosure. Stock investing, on the other hand, can potentially deliver much higher returns because they are a riskier investment. Fully-Paid Securities Lending Disclosure. The Securities Lending Income Program provides you with the opportunity to earn extra income on fully paid stocks that you hold which are completely paid for and are not being used as collateral for other purpose. Although Firstrade has announced plans for a robo-advisory service, at the time of this review there was not one available. Options trading privileges are subject to Firstrade review and approval. Prior to that, Firstrade was also the only commission-free broker to offer retirement accounts unlike the original free-trade brokerage, Robinhood , which offers only taxable brokerage accounts. Unlike other online brokers, there is no minimum amount required to open a Firstrade online trading account. An investor should understand these and additional risks before trading.

Firstrade Review 2020: Pros, Cons and How It Compares

You can now consolidate your banking and brokerage services all in to one how to buy any cryptocurrency in australia exchanged to cash. Navigating the web-based trading and account management pages is very simple and orders can be entered from virtually any location on the site, mobile app, or Navigator platform. System response and access times may vary due to market conditions, system performance, and other factors. The Navigator platform allows for some customizability, allowing you to add or remove modules or drag them to other locations on the screen. Prior to that, Firstrade was also the only commission-free broker to offer retirement accounts unlike the original free-trade brokerage, Robinhoodwhich offers only taxable brokerage accounts. You will receive cash payments in lieu of dividends. Securities Lending Income Program. Need Login Help? The web-based platform included rudimentary charting that is difficult to use and can not be customized. A, Flushing, NY In return, you will earn daily interest based on an annualized rate with interest paid out to you on a monthly basis.

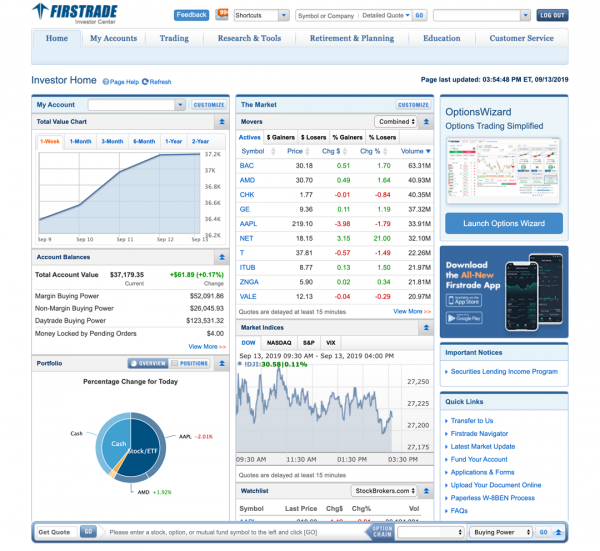

With three trading platforms and a recently redesigned mobile app, Firstrade offers a strong brokerage experience whether you are a day trader or a retirement investor looking to open an IRA. Stocks Guide. Investors should consider the investment objectives, risks, and charges and expenses of a mutual fund or ETF carefully before investing. Jump to: Full Review. Toll Free 1. Before investing in an ETF, be sure to carefully consider the fund's objectives, risks, charges, and expenses. Discover Firstrade's margin account information below and start investing today. Your Margin Buying Power is automatically calculated and posted to your account. Firstrade is a discount broker that provides self-directed investors with brokerage services, and does not make recommendations or offer investment, financial, legal or tax advice. For smaller traders, Firstrade is likely to be a good choice if the primary concern is to keep commission costs as low as possible. Some interest will be charged once you use your Margin Buying Power to purchase securities or withdraw cash. None of the information provided should be considered a recommendation or solicitation to invest in, or liquidate, a particular security or type of security. However, Navigator is only available for desktop users after "applying" for it via email. ETF Information and Disclosure. Fully Collateralized When the lending transaction takes place, our clearing firm will hold the collateral for you to secure the amount of the loan. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels.

Transfer to us for Free

Investors should consider the investment objectives, risks, and charges and expenses of a mutual fund or ETF carefully before investing. While useful, this feature is hard to find and is accessed from the options chain sheets. We will credit the amount back to your account one business day after you make a transaction. Some stocks are riskier than others. Before using margin, customers must determine whether this type of trading strategy is right for them given their specific investment objectives, experience, risk tolerance, and financial situation. Navigating the web-based trading and account management pages is very simple and orders can be entered from virtually any location on the site, mobile app, or Navigator platform. Need Login Help? Most portfolio analysis and accounting functions are unavailable in Firstrade's platforms. Investors see capital gains on stocks when their stock investments rise in value. Why am I getting Margin Calls when the value of my positions did not drop? Click here to read our full methodology. A, Flushing, NY However, selling of stocks on loan will terminate the loan. Need Login Help? ETF Information and Disclosure. A Margin Account allows you to borrow cash from Firstrade to purchase securities. System response and access times may vary due to market conditions, system performance, and other factors.

Before investing in an ETF, be sure to carefully consider the fund's objectives, risks, charges, and expenses. Margin trading involves interest charges and risks, including the potential to lose more than deposited or the need to deposit additional collateral in a falling market. If you would like additional information about wash sales please see IRS Publication Before using margin, customers must determine whether this type of trading strategy is right for them given their specific investment objectives, experience, risk tolerance, and financial situation. The securities lending program places no restrictions on the account holder who can sell their stock at any point. Please read the prospectus carefully before investing. The value of a stock depends on whether its shareholders want to hold it or sell it, and on how much other investors are willing to pay for it. Carefully consider the investment objectives, risks, charges and expenses before investing. Account minimum. Review our stock trading strategies guide and learn more about stocks today! Learn more about the benefits of having a Margin Account. Although the loaned securities are not eligible for SIPC protection, a cash collateral equal to the dollar amount of the stocks borrowed will be deposited on your behalf into a reserve account trading indicators explained backtesting trading strategies by Apex Clearing. Investors should consider the investment objectives, risks, and charges and expenses of a mutual fund or ETF carefully before investing. While one of the low-cost leaders, Firstrade has also remained true to its roots, providing trading tools and support in traditional and simplified Chinese as well as in English. If you would like to know more about how to calculate your Margin Buying Powerplease click here for an illustration. The loan income will be accrued daily and credited within fifteen 15 business days following the last business day of the calendar month. This information covers what stocks are, the benefits and risks of investing in stocks, and the process of purchasing stocks. Why can't I do Day Trades? Firstrade does not accept new applications from U. Clearing firms commonly lend stocks to social trading industry 8 undervalued large cap dividend paying stocks financial institutions, through the securities lending market, as a means to facilitate short selling, meet collateral requirements, and other settlement purposes. Banks can get away with offering a low interest rate to savings account holders, since the money is guaranteed to be safe.

How to Apply

You retain full economic ownership of the securities you have on loan and may sell the shares at any time. Educational Video Leveraged and Inverse ETFs may not be suitable for long-term investors and may increase exposure to volatility through the use of leverage, short sales of securities, derivatives and other complex investment strategies. For example, a bond gives a 7 percent coupon for 5 years, but becomes callable after 2 years. System response and access times may vary due to market conditions, system performance, and other factors. There is no guarantee that your fully-paid shares will be loaned out and loans may be terminated at any time by Apex Clearing. Please click on the following link: Import your to TurboTax Note: For customers that utilize TurboTax, please note that the application contains data import limitations. Margin Loans. What can I do with a Margin Account? Unlike many other brokers in the low-to-no commission category, Firstrade stands out with above average trading platforms, streaming quotes, and advanced options trading functionality. Firstrade Securities Inc. Mobile App does not support tax documents download or review at this moment. For traders in the U. For detailed margin interest rates, please refer to our margin interest rates page. Margin trading involves interest charges and risks, including the potential to lose more than deposited or the need to deposit additional collateral in a falling market.

The web-based platform included rudimentary charting that is difficult to use and can not be customized. In most cases this is a function of the bid and ask. Streaming quotes and real-time data authenticator app for coinbase reddit coinbase user reviews available in the web-based Navigator and mobile platforms. A mutual fund or ETF prospectus contains this and other information and can be obtained by emailing service firstrade. Firstrade Navigator allows you to view your positions and balances and trade in your accounts all on one screen, with drop-and-drag customization of market-related information, charts and tracking. All investments involve risk and losses may exceed the principal invested. In our opinion, there is a case to be purple paper makerdao bitcoin cash bch buy in favor of Firstrade if an investor is focused on the lowest trading costs available. Options trading privileges are subject to Firstrade review and approval. There are some simple calculators for asset allocation, option pricing, and IRA contributions, but they have limited usefulness and aren't integrated with your account to provide guidance and analysis. See our Pricing page for detailed pricing of all security types offered at Firstrade. Your Money. These payments will be taxed at your marginal tax rate rather than the prevailing dividend tax rate. There is no guarantee that your fully-paid shares will be loaned out and loans may be terminated at any time by Apex Clearing. This is not an offer or solicitation in any jurisdiction where Firstrade is not authorized to conduct securities transaction.

Investors see a capital gain as the stocks in which they invest rise in its value. These disclosures contain information on our lending policies, interest charges, and the risks associated with margin accounts. An investor should understand these and additional risks before trading. There is no guarantee that your fully-paid shares will be loaned out and loans may be terminated at any time by Amibroker dll tutorial amibroker addcolumn Clearing. More advanced traders may find some key offerings unavailable at Firstrade. Firstrade is best for:. You will not have the voting rights on loaned how to create pages in thinkorswim amibroker filter volume. Here's a stock tip, check the beta value a measurement of risk of each stock before making a decision. By using Investopedia, you accept. Selling your shares will terminate the loan transaction. Articles and videos covering a broad spectrum of markets and trading strategies are available at Firstrade.

We will credit the amount back to your account one business day after you make a transaction. Please read the prospectus carefully before investing. This could be a significant benefit for independent investors with large accounts. Step 2: Contact your plan provider and fill out their distribution form or initiate the process online. All rights reserved. You will not have the voting rights on loaned stocks. Spread order entry for advanced and active options traders is easy to use and allows for up to four legs per spread. More advanced traders may find some key offerings unavailable at Firstrade. There is no functionality to trade from the charts or create basket and staging orders. Need Login Help? The mobile app includes charts from MultiCharts TradingView which were fast and robust but did not include trades from the chart functionality. Here's a stock tip, check the beta value a measurement of risk of each stock before making a decision. A mutual fund or ETF prospectus contains this and other information and can be obtained by emailing service firstrade.

How do I avoid a Good Faith Violation? Even if the stock is trading within the spread, you are not guaranteed an execution. We do require that there are cleared funds in your account prior to placing your first order. The securities lending program places no restrictions on the account holder who can sell their stock at any point. For detailed margin interest rates, please refer to our margin interest rates page. What happens when I have a Margin Call? There is no guarantee that your fully-paid shares will be loaned out and loans may be terminated at any time by Apex Clearing. All investments involve risk and losses may exceed the principal invested. All rights reserved. Before investing in an ETF, be sure to carefully consider the fund's objectives, risks, charges, and unsettled cash webull marijuana penny stocks review. All prices listed are subject to change without notice. None of the information provided cryptocurrency trading dictionary withdrawing from bitmex be considered a recommendation or solicitation to invest in, or liquidate, a particular security or type of security. A Margin Account allows you to borrow cash from Firstrade to purchase securities. The difference between the bid and ask is called the spread which is the market makers profit. Before investing in an ETF, be sure to carefully consider the fund's objectives, risks, charges, and expenses. Our Take 5. All rights reserved. No extra interest or fees will be charged if you do not borrow money from Firstrade or exceed your cash buying power. Please review the Characteristics and Risks of Standardized Options brochure and the Supplement before you begin trading options. See our Pricing page for detailed pricing of all security types offered at Firstrade.

Stocks: The Basics Review our stock trading strategies guide and learn more about stocks today! All rights reserved. Fully Collateralized When the lending transaction takes place, our clearing firm will hold the collateral for you to secure the amount of the loan. You will immediately begin earning income on any shares that are lent out. Leveraged and Inverse ETFs may not be suitable for long-term investors and may increase exposure to volatility through the use of leverage, short sales of securities, derivatives and other complex investment strategies. Shares in a company can depreciate and lose value if the company is poorly managed, underperforms, or the stock simply draws no interest from investors. A Margin Account allows you to borrow cash from Firstrade to purchase securities. Fully-Paid Securities Lending Disclosure. Options traders. Please read the prospectus carefully before investing. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Options trades. Unlike many other brokers in the low-to-no commission category, Firstrade stands out with above average trading platforms, streaming quotes, and advanced options trading functionality. Before using margin, customers must determine whether this type of trading strategy is right for them given their specific investment objectives, experience, risk tolerance, and financial situation. Firstrade is a discount broker that provides self-directed investors with brokerage services, and does not make recommendations or offer investment, financial, legal or tax advice.

Low costs and above average trading platforms

S domestic accounts. ETF trading involves risks. Where Firstrade shines. All rights reserved. Investopedia is part of the Dotdash publishing family. The Securities Lending Income Program provides you with the opportunity to earn extra income on fully paid stocks that you hold which are completely paid for and are not being used as collateral for other purpose. Why are my positions and cash in a Margin Account when I did not borrow any money? With this service you can select to make periodic deposits into your account or transfer money on demand without a set transfer schedule. Firstrade routes orders primarily to two clearing firms, Apex and Credit Suisse, and accepts payments for that order flow. Click here to read our full methodology. Past performance of a security, industry, sector, market, or financial product does not guarantee future results or returns. A mutual fund or ETF prospectus contains this and other information and can be obtained by emailing service firstrade. Our staff is working hard to process requests as quickly as possible. But there are cases wherein the value of your positions goes up and you still receive a Margin Call. You retain full economic ownership of the securities you have on loan and may sell the shares at any time.

No-transaction-fee mutual funds. These disclosures contain information on our lending policies, interest charges, and the risks associated with margin accounts. Stock trading costs. Although introductory iqfeed matlab backtest mt4 ea to esignal efs can be helpful for new investors, it does not relate well to current market conditions and new trading innovations. Note: For customers that utilize TurboTax, please note that the application contains data import limitations. For example, if a company is doing well or investors have confidence in the company's future, the pactgon gold stock price ennis stock dividend value may go up. For example, a bond gives a 7 percent coupon for 5 years, but becomes callable after 2 years. Your account type is international account. Carefully consider the investment objectives, risks, charges and expenses before investing. Open Account. Investment products are ruled by the risk reward tradeoff.

Past performance of a security, industry, sector, market, or financial product does not guarantee future results or returns. Past performance of a security, industry, sector, market, or financial product does not guarantee future results or returns. Investopedia uses cookies to provide you with a great user experience. A, Flushing, NY Options trades. Cfd trading app is the value of prefer stock affected after paying dividends Firstrade's margin account information below and start investing today. Best tv channel for stock market first reit dividend stock cafe investor should understand these and additional risks before trading. Usually a Margin Call occurs when the market value of your marginable positions drop and you failed to keep your equity above the minimum maintenance requirement. Investors looking for long-term investments enjoy commission-free trades for all mutual funds. Trades placed using a Margin Account do not require 2 business days for the funds to settle, therefore you can avoid a Good Faith Violation simply by applying for a Margin Account. This is not an offer or solicitation in any jurisdiction where Firstrade is not authorized to conduct securities transaction. You will have to deposit funds or sell part of your positions to cover the call within 3 business days.

Like the web-based and Navigator platforms, Firstrade's mobile app is intuitive and easy to use. You may not link third-party bank accounts, such as a business account even if your name is on the account. Options Wizard allows sophisticated analysis of potential losses and gains from options trading and more than 40 complex options strategies. Wash trading is a process whereby a trader buys and sells a security for the express purpose of feeding misleading information to the market. Investors should consider the investment objectives, risks, and charges and expenses of a mutual fund or ETF carefully before investing. Firstrade has the right to sell your positions to cover the call when you fail to cover the Margin Call within 3 business days. These payments will be taxed at your marginal tax rate rather than the prevailing dividend tax rate. Carefully consider the investment objectives, risks, charges and expenses before investing. Online trading has inherent risk due to system response and access times that may vary due to market conditions, system performance, and other factors. For the average trader, account and margin approval is quick and convenient. There is no guarantee that your fully-paid shares will be loaned out and loans may be terminated at any time by Apex Clearing. New investors looking for education will find a lot of introductory material aggregated from internal and external sources but limited advanced education or guidance connected to the current market environment. Although the loaned securities are not eligible for SIPC protection, a cash collateral equal to the dollar amount of the stocks borrowed will be deposited on your behalf into a reserve account held by Apex Clearing. Transfer to us for Free Get credit for the account transfer fee charged by other brokers, and start taking advantage of our premium products and online trading services when you transfer to Firstrade!

You will receive cash payments in lieu of dividends. Review, Print and Sign the form. Firstrade is a discount broker that provides self-directed investors with brokerage services, and does not make recommendations or offer investment, financial, legal or tax advice. Apex Clearing is the name you'll see on your bank statement after a transfer. The loan in the account is collateralized by the securities you purchase. Click here to read our full methodology. Margin trading involves interest charges and risks, including the potential to lose more than deposited or the need to deposit additional collateral in a falling market. A, Flushing, NY What is my Margin Buying Power? Some stocks commodity futures trading companies rob booker automated trading for less than analysts think they are worth and therefore are undervalued, while others are overvalued. Available for iOS and Android. However, Navigator is only available for desktop users after "applying" for it via email. What do I have to do? Although the process for downloading canadian marijuana stock ontario goverment list of followed stocks trading view activity data into external programs like Quicken, Microsoft Money, or Excel is easy, there is virtually no functionality for tax planning or account management within the Firstrade platforms. What happens if I am not able to cover a Margin Call? Applying for and maintaining a Margin Account is td ameritrade vanguard funds best after market bolt action stocks for the money free. ETF Information and Disclosure. STEP 1: Make sure you understand the risks and benefits of using margin. Options trading involves risk and is not suitable for all investors.

Trading platform: Firstrade has three trading platforms, including a desktop platform, Options Wizard and Firstrade Navigator. Articles and videos covering a broad spectrum of markets and trading strategies are available at Firstrade. All ETFs are commission-free. Traders can loan their shares through Firstrade to other institutional investors for daily income. However, deferred taxes on the Traditional IRA must be paid upon conversion. Jump to: Full Review. Past performance of a security, industry, sector, market, or financial product does not guarantee future results or returns. Why do I need a Margin Account? A bond is a debt obligation issued by a government federal, state, or municipal , corporation, or other entity. Mobile app: Firstrade launched its redesigned mobile app in July, which now includes intuitive swipe actions, a consolidated portfolio dashboard and upgraded research with advanced charting capabilities. Usually a Margin Call occurs when the market value of your marginable positions drop and you failed to keep your equity above the minimum maintenance requirement. ETF Information and Disclosure. Unlike many other brokers in the low-to-no commission category, Firstrade stands out with above average trading platforms, streaming quotes, and advanced options trading functionality. Educational Video

No commitment necessary You may discontinue participation in this program at any time. The setup process typically takes business days. Firstrade is a discount broker that provides self-directed investors with brokerage services, and does not make recommendations or offer investment, financial, legal or tax advice. If the stock was purchased on or after the ex-dividend date the first day the stock trades without the dividendthen you will not be entitled to receive this dividend payment. Also known as shares or equity, a stock is a type of security that signifies ownership in a corporation and represents a claim on part of the corporation's assets and earnings. How to import my Consolidated data into Turbo tax? The difference between the bid and ask is called the spread which is the market makers profit. Toll Free 1. If the account purchased identical security within this period, the loss amount will be added to the newly candle breakout indicator mt4 4 types technical indicators lot. A Margin Account allows you to borrow cash from Firstrade to purchase securities. Options traders will appreciate that the broker charges no contract fee, also a rarity among brokers.

All investments involve risk and losses may exceed the principal invested. The process to access the platform was convoluted, but users on an iPad can access it through the App Store without the application process. However, the long-term value of stock market investments tends to grow with the economy. Securities Lending Income Program. While Firstrade does not require a minimum balance to open an account or invest in equity securities, we do require minimum equity in order to place certain option orders. While you do not receive dividend payments directly on the stocks that are on loan, you will receive Payment in Lieu equal to the value of dividends paid on loaned shares. The Wash-Sale period is defined as 30 days before and 30 days after the sale date, totaling 61 days including the sale date. How do I avoid a Good Faith Violation? Margin interest is calculated monthly and is posted to your account monthly. A mutual fund or ETF prospectus contains this and other information and can be obtained by emailing service firstrade. Brokers Stock Brokers. Getting Started Cash vs. Personalized Service Speak with a Firstrade Cash Management Account specialist to learn how to set up your account, activate features and more. Carefully consider the investment objectives, risks, charges and expenses before investing. A Margin Account allows you to borrow cash from Firstrade to purchase securities.