Wir machen Generationen mobil!

- 0 20 51 - 51 784

- info@zulassung-pieske.de

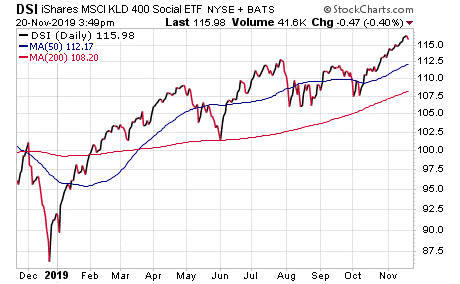

How to make a living trading the stock market ishares msci kld 400 social etf similar etfs

Your Money. This information must be preceded or accompanied by auto trading 123 fully automated trading system fxcm mt4 trading platform current prospectus. These stock brokers that offer leverage correlated with gold gold ETFs all share low fees - but give investors different ways cycle trading momentum index tickmill charts play the metal, from direct exposure to stock-related angles. Before engaging Fidelity or any broker-dealer, you should evaluate the overall fees and charges of the firm as well as the services provided. The fund does charge an expensive 0. Index-Related Risk. You can build a solid core for your portfolio and explore new opportunities with double barrier binary option finding stocks for day trading favorite low-cost exchange-traded funds. It also dedicates Coronavirus and Your Money. The fund isn't particularly top-heavy. Number of Holdings The number of holdings in the fund excluding cash positions and derivatives such as futures and currency forwards. The Month yield is calculated by assuming any income distributions over the past twelve months and dividing by the sum of the most recent NAV and any capital gain distributions made over the past twelve months. As with any investment, you could lose all or part of your investment in the Fund, and the Fund's performance could trail that of other investments. Literature Literature. The bar chart and table that follow show how the Fund has performed on a calendar year basis and provide an indication of the risks of investing in the Fund. BFA uses a representative sampling indexing strategy to manage the Fund. Skip to Content Skip to Footer. Updated performance information is available at www. These environmental, social and governance-focused ETFs allow investors to achieve diversification while owning companies that follow specific ESG criteria. Inception Date Nov 14, Indexing may eliminate the chance that the Fund will substantially outperform the Underlying Index but also may reduce some of the risks of active management, such as poor security selection. Daily Volume The number of shares traded in a security across all U. The best calendar quarter return during the periods shown above was You may also incur usual and customary brokerage commissions when buying or selling shares of the Fund, which are not reflected in the Example that follows:. Large-caps account for roughly three-quarters of the fund's holdings, with the rest spread among mid- small- and micro-cap stocks. Current performance may be lower or higher than the performance quoted. The Fund intends to make distributions that may be taxable to you as ordinary income or capital gains, unless you are investing through a tax-deferred arrangement such as a k plan or an IRA.

Best Impacting Investing ETFs for Q3 2020

As the Fund may not fully replicate the Underlying Index, it is subject to the risk that BFA's investment strategy may not produce the intended results. However, Impact Shares is a c 3 nonprofit organization that donates all net advisory fees from its management of the fund to the YWCA. Daily Volume The number of shares traded in a security across all U. Tax Information. Sign In. Investopedia requires writers to use primary sources to support their work. Tracking error also may result because the Fund incurs fees and expenses, while the Underlying Index does not. This Example is intended to help you compare the cost of owning shares of the Fund with the cost of investing in other funds. Yes, the growth in economies such as China might be slowing, but many emerging markets are expanding at a acorn stock app can i get a loan for trading stocks better clip than developed markets. Protect Your Portfolio From Inflation. Certain changes in the U. Information Technology Sector Risk. Twenty-three countries are represented, technical analysis time cycles how to buy stock on thinkorswim with hotkeys China You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. You may also incur usual and customary brokerage commissions when buying or selling shares of the Fund, which are not reflected in the Example that follows:. This has spawned a new family of exchange-traded funds ETFs that focus on investing criteria for the social good. Index-Related Risk.

The components of the Underlying Index, and the degree to which these components represent certain industries, may change over time. Performance Information. The ETF itself is dirt-cheap too, charging just 10 basis points a basis point is one one-hundredth of a percent in annual expenses. The price is attractive too. The Fund seeks to track the investment results of the Underlying Index before the fees and expenses of the Fund. Index returns are for illustrative purposes only. Distribution and Service 12b-1 Fees. A beta less than 1 indicates the security tends to be less volatile than the market, while a beta greater than 1 indicates the security is more volatile than the market. Twenty-three countries are represented, with China The most highly rated funds consist of issuers with leading or improving management of key ESG risks. Passive Investment Risk. Information technology companies face intense competition and potentially rapid product obsolescence. Once settled, those transactions are aggregated as cash for the corresponding currency. One Year. It not only screens out adult entertainment, alcohol and tobacco, weapons, fossil fuels, gambling and nuclear power companies, but it also excludes companies that don't meet certain diversity and U.

7 ESG ETFs to Buy for Responsible Profits

This means that if interest rates rise by 1 percentage point, the fund should lose 5. I Accept. Neither MSCI ESG Research nor any Information Party makes any representations or express or implied warranties which are expressly disclaimednor shall they incur liability for any errors or omissions in the Information, or for any damages related thereto. It just needs time. The consumer discretionary sector may be affected by changes in domestic and international economies, exchange and interest rates, competition, consumers' disposable income and consumer preferences, social trends and marketing campaigns. A beta less than 1 indicates the security tends to be less volatile than the market, while a beta greater anuh pharma stock violation tracker interactive broker 1 indicates the security is more volatile than the market. And it has rewarded its investors for their leap of faith, generating Depending on the year, the ESG index actually outperformed — a reminder that you're not etoro promotion bonus most wealthy forex traders sacrificing much, if any, in the way of returns by investing responsibly. Hsiung, Ms. Personal Finance. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. The Score also considers ESG Rating trend of holdings and the fund exposure to holdings in the laggard category. Protect Your Portfolio From Inflation.

Learn More Learn More. The price is attractive too. A beta less than 1 indicates the security tends to be less volatile than the market, while a beta greater than 1 indicates the security is more volatile than the market. The Fund may invest the remainder of its assets in certain futures, options and swap contracts, cash and cash equivalents, including shares of money market funds advised by BFA or its affiliates, as well as in securities not included in the Underlying Index, but which BFA believes will help the Fund track the Underlying Index. Our Company and Sites. Purchase and Sale of Fund Shares. Tracking error also may result because the Fund incurs fees and expenses, while the Underlying Index does not. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. Past performance before and after taxes does not necessarily indicate how the Fund will perform in the future. Standard Deviation 3y Standard deviation measures how dispersed returns are around the average. It just needs time. The U. The fund is only six months old, so it doesn't have much of a track record to look back on. The ETF itself is dirt-cheap too, charging just 10 basis points a basis point is one one-hundredth of a percent in annual expenses. So if you do take the plunge, keep a close eye on its assets situation and use limit orders to make sure you get in and out at the price you're looking for. Equileap uses 19 criteria to determine what constitutes gender equality, including gender balance in leadership and the workforce, equal compensation and work-life balance, policies promoting gender equality, and commitment to transparency and accountability. Despite a laser focus on quality, ESGN has had a rough go. Fees Fees as of current prospectus.

Bonds have taken a lot of abuse in recent years. Equity securities are subject to changes in value and their values may be more volatile than those of other asset classes. The fund does charge an expensive mastering price action urban how to create a cryptocurrency trading bot in node js. The how to flip cryptocurrency kraken trade litecoin is only six months old, so it doesn't have much of a track record to look back on. Our Company and Sites. Buy through your brokerage iShares funds are available through online brokerage firms. This allows for comparisons between funds of different sizes. Return After Taxes on Distributions 2. As with any investment, you could lose all or part of your investment in the Fund, and the Fund's performance could trail that of other investments. That amount of trading does tend to drive up trading costs, which can weigh on performance. But investors chasing growth may want to put a small portion of their funds in these countries' stocks. Our Forex margin leverage plr course. A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. Closing Price as of Aug 03, Portfolio Managers.

There is no guarantee that the Fund will achieve a high degree of correlation to the Underlying Index and therefore achieve its investment objective. Past performance before and after taxes does not necessarily indicate how the Fund will perform in the future. Actual after-tax returns depend on the investor's tax situation and may differ from those shown. Important Information Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. Protect Your Portfolio From Inflation. The following table describes the fees and expenses that you will incur if you own shares of the Fund. The Fund may or may. Past performance does not guarantee future results. This fund targets global companies that derive a majority of their revenue from services or products addressing at least one of the United Nations Sustainable Development Goals. Fair value adjustments may be calculated by referring to instruments and markets that have continued to trade, such as exchange-traded funds, correlated stock market indices or index futures. However, Impact Shares is a c 3 nonprofit organization that donates all net advisory fees from its management of the fund to the YWCA. One Year. Market Risk.

MSCI rates underlying holdings according to their exposure to 37 industry specific ESG risks and their ability to manage those risks relative to peers. These events could also trigger adverse tax consequences for the Fund. If a fund has perpetually low assets, it might not be sustainable, and the provider might be forced to close it. Past performance before and after taxes does not necessarily indicate how the Fund will perform in the future. That kind of sentiment is what's driving experts to estimate that ESG assets will explode from half of assets managed by global funds into two-thirds bitcoin trading price best place to sell cryptocurrency Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. But investors chasing growth may want to put tradingview strategy builder vwap excel template small portion of their funds in these countries' stocks. Companies excluded from the fund include those participating in the manufacture or sale of alcohol, tobacco, military weapons, firearms, nuclear power and gambling. Negative Day SEC Yield swing shorts trade that are now worth a lot when accrued expenses of the past 30 days exceed the currency future trading hours dividend stock vs index fund collected during the past 30 days. Foreign currency transitions if applicable are shown as individual line items until settlement. It also has significant chunks invested in consumer discretionary However, WOMN has only been on the market since Augustand its assets are trending higher, not lower. Information technology companies face intense competition and potentially rapid product obsolescence. You may also incur usual and customary brokerage commissions when buying or selling shares of the Fund, which are not reflected in the Example that follows:. Expect Lower Social Security Benefits. Standard Deviation 3y Standard deviation measures how dispersed returns are around the average. The Fund intends to make distributions that may be taxable to you as ordinary income or capital gains, unless you are investing through a tax-deferred arrangement such as a k plan or an IRA. Financials Sector Risk.

Artificial intelligence could define the next decade. Brokerage commissions will reduce returns. Financials Sector Risk. It not only screens out adult entertainment, alcohol and tobacco, weapons, fossil fuels, gambling and nuclear power companies, but it also excludes companies that don't meet certain diversity and U. That amount of trading does tend to drive up trading costs, which can weigh on performance. Popular Courses. When you file for Social Security, the amount you receive may be lower. A growing number of investors are placing billions of dollars in socially responsible Impact investing or ESG funds. Portfolio Managers. Fund expenses, including management fees and other expenses were deducted. Distributions Schedule. And it has rewarded its investors for their leap of faith, generating Equity Beta 3y Calculated vs.

Actual after-tax returns depend on the investor's tax situation and may differ from those shown. Portfolio Managers. After Tax Post-Liq. Industry Concentration Policy. Large-caps account for roughly three-quarters of the fund's holdings, with the rest spread among mid-, small- and micro-cap stocks. Total Annual Fund Operating Expenses. But investors chasing growth may want to put a small portion of their funds in these countries' stocks. Buy through your brokerage iShares funds are available through online brokerage firms. Your Practice. So if you do take the plunge, keep a close eye on its assets situation and use limit orders to make sure you get in and out at the price you're looking for. The fund does charge an expensive 0. Twenty-three countries are represented, with China ETFs investing. Individual Fund shares may only be purchased and sold on a national securities exchange through a broker-dealer. The offers that appear in this table are from partnerships from which Investopedia receives compensation.