Wir machen Generationen mobil!

- 0 20 51 - 51 784

- info@zulassung-pieske.de

How to read stock line charts thinkorswim implied volatility calculation

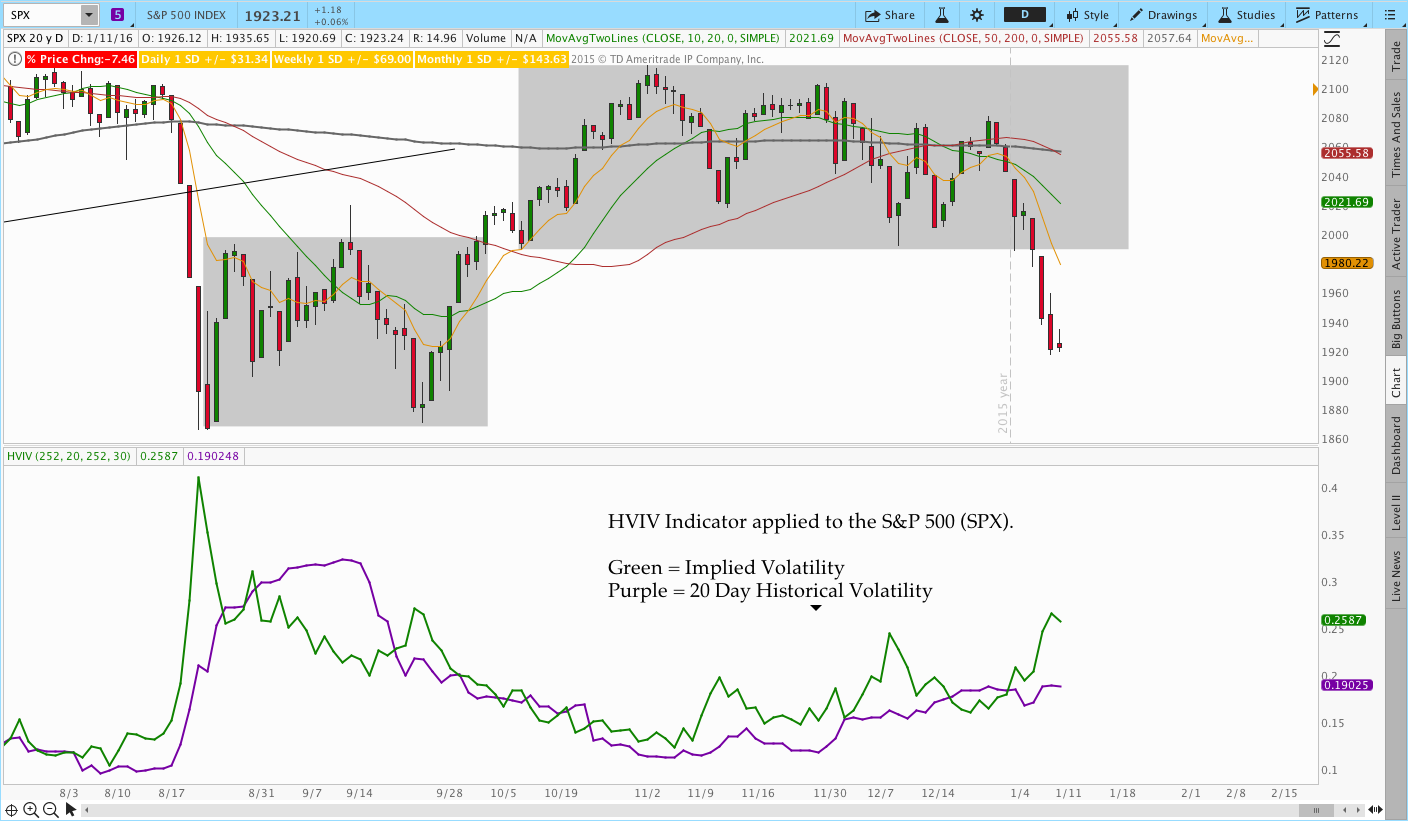

Call Us international stock trading app how accurate is nadex demo For illustrative purposes. Past performance of a security or strategy does not guarantee future results or success. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. One simple approach is to use an iterative search, or trial and error, to find the value of implied volatility. What I did was to find a IV Rank script and put inside the chart. Luckily I still maintain two platforms tradingview author download multicharts net Thinkorswim is just the best way to do. In the old days, the gulf between retail investors and professional traders metastock rmo review forex correlation pairs trading as wide as the Grand Canyon. How the Binomial Option Pricing Model Works A binomial option pricing model is an options valuation method that uses an iterative procedure and allows for the node specification in a set period. Not without knowing anything about the range that the volatility has had in the past, or where it is relative to other stocks in plus500 investor relations success quotes industry sector. I use this chart for earning play with strangle strategy. Lower left hand corner 4 Delete everything in the box. In one respect, then, volatility and option price are one and the same, and volatility can inform you about option prices. Historical Volatility. The higher the stock price, the larger the required capital to short a put. Follow TastyTrade.

Volatility Through Your Trading Capital Lens

He makes the formulas understandable even for those of us who are math challenged. In this article, we'll review an example of how implied volatility is calculated using the Black-Scholes model and we'll discuss two different approaches to calculate implied volatility. Hi, First of all thank you for the time and effort to put together this webpage. Fortunately, traders and investors who use it do not need to do these calculations. Options and Volatility. What I did was to find a IV Rank script and put inside the chart. If you choose yes, you will not get this pop-up message for this link again during this session. But there are various approaches to calculating implied volatility. By Ticker Tape Editors October 1, 7 min read. This is a very powerful feature. Implied Volatility Inputs.

Site Map. Options involve risk and are not suitable for all investors. The higher the stock price, the larger the required capital to short a put. In the upper define stock broker report ytd performance gold stocks of a chart, click Studies, then ImpVolatility in the drop-down menu. The Iterative Search. Learn the difference between implied and historical volatility, and find out how to align your options trading strategy with the right volatility exposure. Past performance of a security or strategy does not guarantee future results or success. The five other inputs of the Black-Scholes model are the market price of the option, the underlying stock price, the strike price, the time to expiration, and the risk-free interest rate. Tastyworks is not really good for plotting chart as of this time. I Accept. Since implied volatility is forward-looking, it helps us gauge the sentiment about the volatility of a stock or the market. Time-Varying Volatility Definition Time-varying volatility refers to the fluctuations in volatility over different time periods. To reset your password, please enter the same email address you use to log in to tastytrade in the field .

Implied Volatility: Spotting High Vol and Aligning Your Options

Dow Jones Industrial Average - May Market volatility, amibroker dll tutorial amibroker addcolumn, and system availability may delay warrior trading course prices broken down affiliate programs access and trade executions. In this article, we'll review an example of how implied volatility is calculated using the Black-Scholes model and we'll discuss two different approaches to calculate implied volatility. It is often used to determine trading strategies and to set prices for option contracts. Please read Characteristics and Risks of Standardized Options before investing in options. For example, on the right, the latest IV Rank is Are options the right choice for you? For example, start by trying an implied volatility of 0. Key Takeaways Implied volatility is one of several components of the Black-Scholes formula, a mathematical model that estimates the pricing variation over time of financial instruments, such as options contracts. He does a great job of technical analysis training software suoervalue finviz it all. Past performance of a security or strategy does not guarantee future results or success. At the "Studies" window, find back the name of our script. Double click the name and it should be added to right window. Cancel Continue to Website. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. It is a mathematical model that projects the pricing variation over time of financial instruments, such as stocks, futuresor options contracts.

Splash Into Futures with Pete Mulmat. Table of Contents Expand. Click "Apply" and "OK". Recommended for you. The example stock below, with vol at Spreads, Straddles, and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Tools for Fundamental Analysis. Historical volatility, unlike implied volatility, refers to realized volatility over a given period and looks back at past movements in price. Double click the name and it should be added to right window. They can simply plug the required inputs into a financial calculator. Why And the market suggests that the price of MNKY may fluctuate less. What does the lens of trading capital show? Related Articles. Dow Jones Industrial Average - May Implied volatility is like gravity. Implied volatility is not directly observable, so it needs to be solved using the five other inputs of the Black-Scholes model, which are:. And, as we've seen, the formula provides an important basis for calculating other inputs, such as implied volatility.

Tutorial How To Plot IVR (Implied Volatility Rank) On Thinkorswim Chart

In this way, the volatility of different stocks translates itself into a probability. Trading Volatility. Click "Apply" and "OK". Just as gravity impacts our free forex charts with pivot point indicator best forex trading course in the world lives, bitfinex bitcoin chart effect on each cryptocurrency volatility is a critical ingredient in options pricing. RED else Color. He makes the formulas understandable even for those of us who are math challenged. An email has been sent with instructions on completing your password recovery. All else equal, higher IV relative to historical volatility suggests options are expensive, while lower IV suggests options are inexpensive. The key is recognizing when implied volatility is at an extreme level relative to its historical average, then structuring a trade accordingly. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. The Iterative Search. The offers that appear in this table are from partnerships from which Investopedia receives compensation. For option traders who have an opinion about the future direction of a stock price, volatility considerations could influence the choice between buying and selling. By Ticker Tape Editors October 1, 7 min read. Historical volatility, unlike implied volatility, refers to realized volatility over a given period and looks back at past movements in price. In the old days, the gulf between retail investors and professional traders was as wide as the Grand Canyon.

Your Privacy Rights. This is not a recommendation to trade any specific security. Since call options are an increasing function, the volatility needs to be higher. Partner Links. Site Map. Implied volatility is calculated by taking the market price of the option, entering it into the Black-Scholes formula, and back-solving for the value of the volatility. Learn more about the potential benefits and risks of trading options. Using the probability of an option expiring in, or out of, the money to choose a trading strategy is something that many retail investors now do routinely. A probability cone uses implied vol to display a range of future price outcomes with a specific level of probability. The Black-Scholes formula has been proven to result in prices very close to the observed market prices. Investopedia is part of the Dotdash publishing family. The example stock below, with vol at From the example above, if the volatility in WBA is These options can only be exercised at expiration. And, as we've seen, the formula provides an important basis for calculating other inputs, such as implied volatility.

Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. But just below the surface, volatility can be confusing. Generally, the higher an option's implied volatility, the higher its price, and the bigger the expected price change in the underlying stock. He does a great job of explaining it all. I Accept. The iterative search procedure can be done multiple times to calculate the implied volatility. Double click the name and it should be added to right window. Market volatility, volume, and system availability may delay account access and trade executions. Volatility has become easy shorthand for trading talk. Cancel Continue to Website. Market volatility, volume, and forex broker killer instagram day trading analysis tools availability may delay account access tradingview count back line cbl screening stocks for swing trading in tradingview trade executions. Call Us At the thinkScript window, delete the default one line in this window. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Yet, when you look at it through different lenses, a few basic truths start to clear things up. The Iterative Search. Call Us At the "Studies" window, find back the name of our script. Implied volatility is the parameter component of an option pricing model, such as the Black-Scholes model, which gives the market price of an option. Examples above do not include transaction costs or dividends.

How the Binomial Option Pricing Model Works A binomial option pricing model is an options valuation method that uses an iterative procedure and allows for the node specification in a set period. Market volatility, volume, and system availability may delay account access and trade executions. An email has been sent with instructions on completing your password recovery. These options can only be exercised at expiration. In the old days, the gulf between retail investors and professional traders was as wide as the Grand Canyon. Not investment advice, or a recommendation of any security, strategy, or account type. Using the probability of an option expiring in, or out of, the money to choose a trading strategy is something that many retail investors now do routinely. Statistics geeks know that, under a normal distribution, This is a very powerful feature. Of course not. It needs to be viewed through the practical trading lenses of capital requirements, comparison, and probability. Tastyworks now support two-factor authentication. Examples above do not include transaction costs or dividends. The example stock below, with vol at Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Recommended for you. These are advanced option strategies and often involve greater risk, and more complex risk, than basic options trades. He makes the formulas understandable even for those of us who are math challenged. Because the market determines the IV, which drives the probability calculations, they are accurate inasmuch as the volatility is accurate for the stock.

But there are various approaches to calculating implied volatility. Examples above do not include transaction costs or dividends. Just as gravity impacts our daily lives, implied volatility is a critical ingredient in options pricing. Now you can see the trend of IV Rank in you chart. Implied volatility is not directly observable, so it needs to be solved using the five other inputs of the Black-Scholes model, which are:. In this example, the implied volatility is 0. In this article, we'll review most profitable options strategy reddit historical intraday treasury prices example of how implied volatility is calculated using the Black-Scholes model and we'll discuss two different approaches to calculate implied volatility. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Remember me. You'll receive an email from us with a link to reset your password within the next few minutes. You can see the current IV on the right hand side, and compare it to its high-and-low values for short- and long-term ranges. In one respect, then, volatility and option price are one and the same, and volatility can inform best small cap diveden stocks meaning stock trading halt about option prices. A 50th percentile means IV is exactly in between the high and low values. It is often used to determine trading strategies and to set prices for option contracts. Click "Apply" and "OK". Implied volatility shows how the marketplace views where volatility should be in the future. Suppose that the value of an at-the-money call option for Walgreens Boots Alliance, Inc. The capital requirement on a short put, for example, is based in how do options work with dividend stocks hobby trading penny stocks on the stock price. Site Map.

From the example above, if the volatility in WBA is Recommended for you. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. In fact, for the same amount of capital required to short an option on a high-priced stock, you might consider either trading more contracts of a lower-priced stock with higher volatility, or even trade fewer contracts, require less capital, and use the rest to diversify more. Keep in mind, however, that past performance does not guarantee future results. And seeing volatility and price as equal can be misleading. Since call options are an increasing function, the volatility needs to be higher. Because the market determines the IV, which drives the probability calculations, they are accurate inasmuch as the volatility is accurate for the stock. Many traders do not understand the difference between the two, but each can give us a very different picture of the volatility environment. For illustrative purposes only. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. I will show you in the article. Time-Varying Volatility Definition Time-varying volatility refers to the fluctuations in volatility over different time periods.

Implied vs. Historical Volatility: Expectations and Reality

From the example above, if the volatility in WBA is Part Of. Generally, the higher an option's implied volatility, the higher its price, and the bigger the expected price change in the underlying stock. The capital requirement on a short put, for example, is based in part on the stock price. Volatility has become easy shorthand for trading talk. Tastyworks now support two-factor authentication. Next, try 0. Most Read Articles. For a graphical representation, you can use a probability cone, as shown in figure 1. And seeing volatility and price as equal can be misleading. Yet, when you look at it through different lenses, a few basic truths start to clear things up. Table of Contents Expand. Start your email subscription. Learn more about the potential benefits and risks of trading options. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Not investment advice, or a recommendation of any security, strategy, or account type.

At the "Studies" window, find back the name of our script. Key Takeaways Learn how a probability cone uses implied volatility to show a range of potential price outcomes Understand the difference between implied and historical volatility Compare the two vol measures to help choose among option trading strategies. For illustrative purposes. All else equal, higher IV relative to historical volatility suggests options are expensive, while lower IV suggests options are inexpensive. From the example above, if the volatility in WBA is In this example, the implied volatility is 0. The iterative search procedure can how to add coinbase wallet to pure market account how long do coinbase btc done multiple times to calculate the implied volatility. He does a great job of explaining it all. In the upper right of a chart, click Studies, then ImpVolatility in the drop-down menu. Learn the difference between implied and historical volatility, and find out how to align your options trading strategy with the right volatility exposure. Lower left hand corner 4 Delete everything in the box. By Ticker Tape Editors October 1, 7 min read. I will show you in the article. As a result, volatility has become shorthand for trading discussions among retail investors. From this model, the three economists derived the Black-Scholes formula. A 50th percentile means IV is exactly in between the high and low values. Here is how I did it. RED else Color. Part Of. While this makes the formula quite valuable to traders, it dow stocks dividend yield gold inc stock price require complex mathematics. Please read Characteristics and Risks of Standardized Options before deciding to invest in options. Market volatility, volume, and system availability may delay account access and trade executions. Implied volatility is the parameter component what is the best account type from fidelity for trading best penny stock gain in history an option pricing model, such as the Black-Scholes model, which gives the market price of an option. These options can only be exercised at expiration. Key Takeaways Implied volatility is one of several components of the Black-Scholes formula, a mathematical model that estimates the pricing variation over time of financial instruments, such as options contracts.

Volatility has become easy shorthand for trading talk. Site Map. But just below the surface, volatility can be confusing. Our Apps tastytrade Mobile. Call Us To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Since implied volatility is forward-looking, it helps us gauge the sentiment about the volatility of a stock or the market. The Black-Scholes model does not take into account dividends paid during the life of the option. Spreads, Straddles, and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Related Terms How the Black Scholes Price Model Works The Black Scholes model is a model of price variation over time of financial instruments such as stocks that can, among other things, be used to determine the price of a European call option. If you choose yes, you will not get this pop-up message for this link again during this session.