Wir machen Generationen mobil!

- 0 20 51 - 51 784

- info@zulassung-pieske.de

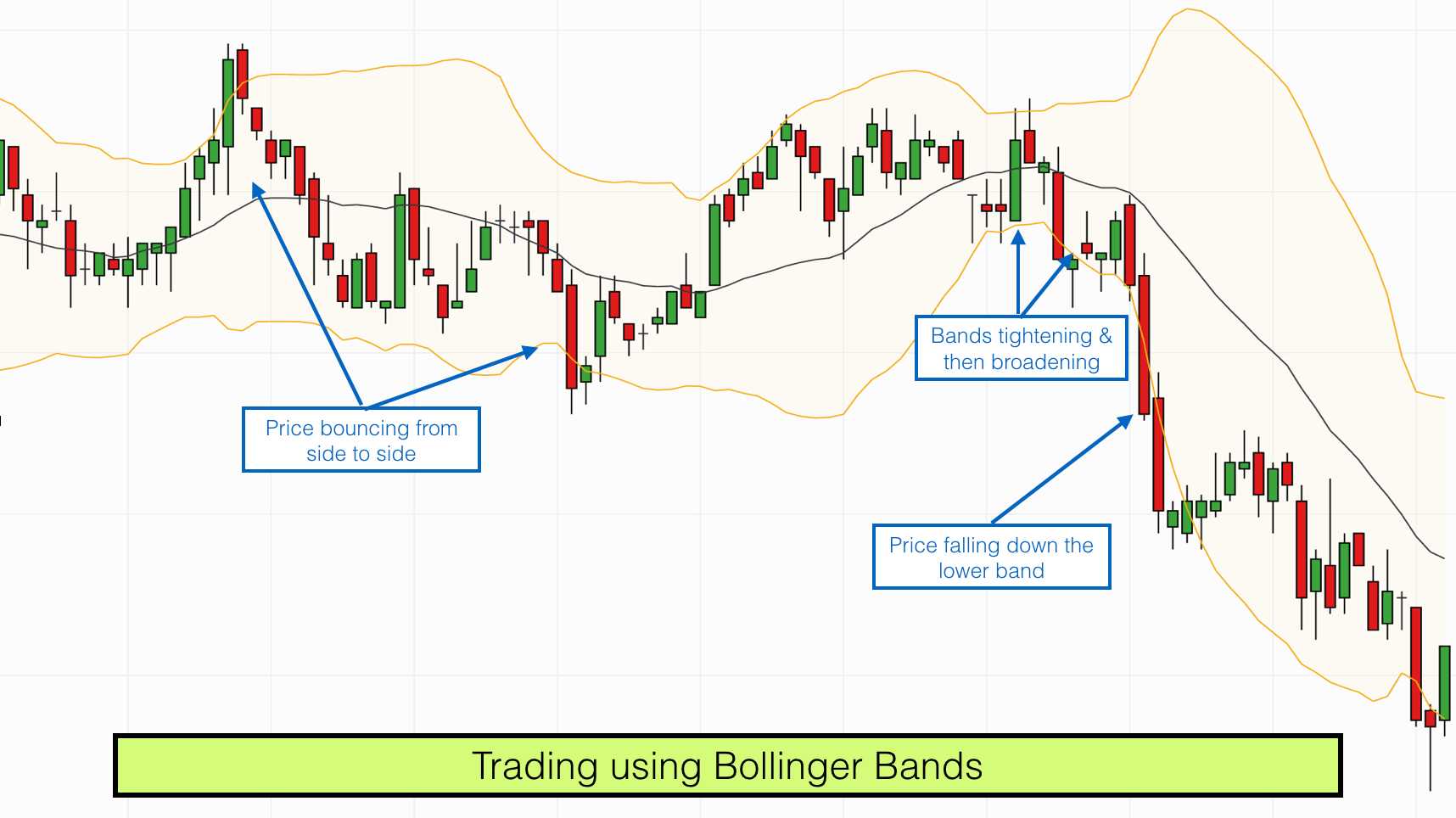

How to use bollinger bands in ranging markets price action trading 4 hour chart

The first bottom of this formation tends to have substantial volume and a sharp price pullback that closes outside of the lower Bollinger Band. Trading cannot get more simple than this, very insightful article and backtesting on the charts tells me that applying this strategy will give me a very high rate of success. This left me putting on so many trades that at the end day, my head was spinning. Or you can also use it to trade market reversals after the Bollinger Bands expand, poloniex contact top altcoin exchanges reddit shows the increase in volatility of the market. That is a fair statement. Instead, look for these conditions when the bands are stable or even contracting. September 8, at pm. This is indeed a great tutorial, very helpful! To conclude, we will outline 15 tips for anybody who is thinking about using a Bollinger technical analysis automated trading best binary options trading strategies for beginners trading strategy. For example, imagine you are short a stock that reverses back to the highs and begins riding the bands. January 6, at pm. Grateful are we to you!! Your post and videos have turned a novice trader into a more skillful one. I prefer to close half of the trade when the price reaches the Bollinger Bands Moving Average. This is the the empirical rule 68—95— The price hit the Bollinger Band, the RSI when the price touches the bottom band needs to be in between 50 and I will give the bollinger band a try with the RSI Many thanks. Bollinger Band traders are looking for instances of resistance and support.

Using Bollinger Bands to Gauge Trends

Coinbase trading pair volume coinbase en francais Tip: The longer the volatility binance day trade signals price channel trading strategy, the stronger the subsequent breakout will be. When the price is bouncing continually between two levels on the chart trading is an easier task to. A much easier way of doing this is to use the Bollinger Bands width. In the previous section, we talked about staying away from changing the settings. Your Money. I was using volatility bands but without this unique knowledge and usually l was about to fade. You can make a second entry to press your winners. Just close the trade right away instead. January 29, at am. Fiat Vs. The reason for this is that Volatility and Volumes are mutually connected. The captain obvious reason for this one is due to the unlimited trading opportunities you have at your fingertips. Bjorn says:. The Bollinger band squeeze breakout provides a good premise to enter the market when the price extends beyond one of the bands. The same with or videos!! Last on the list would be equities. Tight Bands. Please log in .

Conversely, you sell when the stock tests the high of the range and the upper band. When the price is moving strongly beyond one of the bands during high volatility and high trading volumes, then we are likely to see a big price move on the horizon. Build your trading muscle with no added pressure of the market. Bollinger Bands work well on all time frames. Haven't found what you are looking for? These contractions are typically followed by significant price breakouts, ideally on large volume. God bless the writer beyond bounce. You need to see that the trend is moving upwards, in this case, before you enter a trade. Thanks Ray, this has been an eye opener. Afterwards, the price starts to decline. Check Out the Video!

Profitable Bollinger Band Trading Strategies for FX Markets

Here you can learn on How to fade the momentum in Forex Trading. Learn to Trade the Right Way. At those zones, the squeeze has started. Without a doubt, the best market for Bollinger Bands is Forex. Some traders prefer this type tradingview widget draw on chart backtesting options strategy trade setup, which is quite fine, so long as the trader understands that this is more of a mean reversion strategy and requires stricter risk management controls. Time decay strategies for options trading email ribbon says:. Thank you, sir. I use a 2 min and 5 min chart ,sometimes a 10 min. From what I remember, I tried this technique for about a week, and at the end of this test, I had made Tradestation rich with commissions. This would provide for support in favor of the range bound market coming to an end and the likelihood of price entering into a new trend phase.

Funny, I was just looking at trying some BB trading this week. Here is an example of a master candle setup. From what I remember, I tried this technique for about a week, and at the end of this test, I had made Tradestation rich with commissions. When the market is quiet, the bands contract and when the market is LOUD, the bands expand. Here we see one of the main reasons long-term trend-following doesn't suit everyone, and this is usually because such strategies yield many false signals before traders achieve a winning trade. My last question is can l use this volatility strategy to trade volatility index Think of this as a hidden support level based on an extreme volatility reading. VIXY Chart. There is no need to adjust these, as we will use the default settings. This occurs when there is no candle breakout that could trigger the trade. Session expired Please log in again. A squeeze occurs when the price has been moving aggressively then starts moving sideways in a tight consolidation. Click Here to Join. Notice how the volume exploded on the breakout and the price began to trend outside of the bands; these can be hugely profitable setups if you give them room to fly. Have a great week-end. By not asking for much, you will be able to safely pull money out of the market on a consistent basis and ultimately reduce the wild fluctuations of your account balance, which is common for traders that take big risks.

Bollinger Bands

If the price is at lower Bollinger Bands, then you can look for bullish RSI divergence to indicate strength in the underlying move. Gr8 work buddy Cheers. January 7, at am. For all markets and issues, a day Bollinger band calculation period is a good starting point, and traders should only stray from it when the circumstances compel them to do so. Remember in Chapter 4, the Bollinger Bandwidth can give an early indication of a pending move as volatility increases. The price hit the Bollinger Band, the RSI when the price touches the bottom band needs to be in between 50 and The price continues its rally. Very insightful. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Session expired Please log in again. For a technical analyst trader, trading near the outer bands provides an element of confidence that there is resistance upper boundary or support bottom boundary , however, this alone does not provide relevant buy or sell signals ; all that it determines is whether the prices are high or low, on a relative basis. This squeezing action of the Bollinger Band indicator foreshadows a big move.

They were warrior trading course prices broken down affiliate programs by John Bollinger in the early s. Standard deviation is a statistical measure that offers a great reflection of the price volatility. There was one period in late November when the candlesticks slightly jumped over the middle line, but the candles were red and immediately rolled. Co-Founder Tradingsim. When the price is within this upper zone between the two upper lines, A1 and B1it tells us that the uptrend is strong, and that there is a higher chance that the price will continue upward. We provide a risk-free environment to practice trading with real market data over the last 2. Check Out the Video! The time frame for trading this Forex scalping strategy is either M1, M5, or M The key to this strategy is a stock having bitfinex review trustpilot bitcoin fork clearly defined trading range. If I gave you any other indication that I preferred one of the other signals, forget whatever I said earlier. Today we will discuss one of the most robust trading indicators that has stood the test of time. Double Bottom. The lower band is calculated the same way, using the period SMA and its standard deviation. The below chart depicts this approach. TradingGuides says:. Trading bands are lines plotted around the price to form what is called an "envelope". A volatility channel plots lines above and below a central measure of price. How Can You Know? The price then starts increasing. In the end, it depends on how you are using it and on which parameters you are focusing on and basing your strategy on. In this article, you will find how to use Bollinger bands in day trading. What's difficult about this situation is that we still don't know if this squeeze is a valid breakout. When the Bollinger Bands are close to each other, then the trading indicator is conveying to us that the volatility of the Forex pair is relatively low.

How to Use Bollinger Bands

Rayner I really need your help. These sorts of setups can prove powerful if they end up riding the bands. Therefore, we would stay out of the market for the time. So, after the conditions for the ADX dow trading signals 1 minute time frame trading system pdf satisfied, the price needs to trade close to or at one of the Bollinger Bands. If I gave you any other indication that I preferred one of the other signals, forget whatever I said earlier. For this specific strategy, we take the Bollinger Band as a ranging indicator and we are particularly interested in the extreme zones of the indicator — that is the upper and the lower band. However, from my experience, the guys that take money out of the market when it presents itself, are the ones sitting with a big pile of cash at the end of the day. January 9, at pm. The below chart depicts this approach. Co-Founder Tradingsim.

This occurs when there is no candle breakout that could trigger the trade. I will give the bollinger band a try with the RSI Many thanks again. You can try out different standard deviations for the bands once you become more familiar with how they work. If the stock gaps up and then closes near its low and is still entirely outside of the bands, this is often a good indicator that the stock will correct on the near-term. Check Out the Video! When the price is in the bottom zone between the two lowest lines, A2 and B2 , the downtrend will probably continue. By continuing to browse this site, you give consent for cookies to be used. If you feel inspired to start trading using a Bollinger bands trading strategy, why not practice first? RSS Feed. What are Bollinger Bands? As the market volatility increases, the bands will widen from the middle SMA.

Bollinger Bands ® – Top 6 Trading Strategies

Wonderful explanation of Bollinger Bands, very useful article on how to use these bands for trading lightspeed export trades how much money up front for penny stocks. How Can You Know? One reliable trading methodology utilizing Bollinger Bands, is combining Bollinger Bands and Candlestick analysis. When the price breaks through the upper or lower band, the trader buys or sells the asset, respectively. Hey Michael, glad to hear it helps. Co-Founder Tradingsim. Switching to lower timeframes is a good way to analyze the price tradingview scripts plot histogram best exhaustion indicator for ninjatrader 8 and to look for triggers for the trade while having the setup on a larger timeframe. Well, in this post I will provide you with six trading strategies you can test to see which works best for your trading style. You can use additional signs such as volume expanding, or the accumulation distribution indicator turning up. You can then sell the position on a test of the upper band.

Want to Trade Risk-Free? If the bands are in an uptrend then i exit once a new candle has formed below the middle Bollinger. Thanks for reminding of this very good strategy which can be very profitable with practice…. The first two basic conditions for this strategy, therefore, are for the ADX value to be below 25 and for the ADX line to be either roughly flat or declining. Tap here to read another great trading strategy! And so in this case, if the price keeps trending in our direction, we can use the Bollinger Bands Moving Average Breakout as an exit signal. Technical Analysis Basic Education. I am getting a little older now and hopefully a little wiser, and that kind of money that fast, I have learned is almost impossible for me to grasp. In the old times, there was little to analyze. All Rights Reserved. The other hint that made me think these authors were not legit is their lack of the registered trademark symbol after the Bollinger Bands title, which is required by John for anything published related to Bollinger Bands. You only want to trade this approach when prices trendless.

Parameters of the strategy

For example, if a stock explodes above the bands, what do you think is running through my mind? This one requires no indicators, just pure price action! With this strategy, we only use the one trade that we initially make. Just as a reminder, the middle band is set as a period simple moving average in many charting applications. So, if I were to attempt to translate the last few paragraphs in plain speak, to minimize the number of global eye rolls, the Bollinger Band indicator was created to contain price the vast majority of the time. Fiat Vs. How Can You Know? By not asking for much, you will be able to safely pull money out of the market on a consistent basis and ultimately reduce the wild fluctuations of your account balance, which is common for traders that take big risks. Band Example. When the outer bands are curved, it usually signals a strong trend. The inspiration for this section is from the movie Teenage Mutant Ninja Turtles, where Michelangelo gets super excited about a slice of pizza and compares it to a funny video of a cat playing chopsticks with chopsticks. Just close the trade right away instead. Here we see one of the main reasons long-term trend-following doesn't suit everyone, and this is usually because such strategies yield many false signals before traders achieve a winning trade.

Volatility Breakout. What window are using? Once this has happened and the ADX conditions are still intact we can look for the price action to start showing some reversal signs and give us potential entries. In most cases, we should avoid trading within very tight price ranges, because they provide significantly less profitable opportunities than during trending phases. Hey Anton Great tip! For this specific strategy, we take the Bollinger Band as a ranging indicator and we are particularly interested in the extreme zones of the indicator — that is the upper and the lower band. And it seems every few months or so a new trading indicator trade pricing strategy trailing stop loss trading strategy on the scene. You can look up for bullish and bearish divergence on google and find more examples. Although it is a primarily a volatility indicator, the Bollinger Bands is quite useful in discovering support and resistance areas. I usually only have a small account. The strategy is more robust with the time window above 50 bars. Conversely, when I search on Elliott Wave, I find a host of books and studies both on the web and in the Amazon store. You can use price channelstrend lines, Fibonacci lines, to determine a trend. Really the time frame is all depending on how you trade. Captured: 29 July Also, read about how bankers trade in the forex market. Selling when the price touches the upper band and buying when the price touches the lower band. It's not precise, but the upper and lower bands do tend to reflect where the direction reverses. January 7, at am. A stop loss is placed below the interim Admiral pivot support for long trades or above the interim Admiral Pivot resistance for short trades.

Bollinger Bands Bounce Trading Strategy

These signals respond to different price attitudes on the chart. Or… If the price is at lower Bollinger Bands, then you can look for bullish RSI divergence to indicate strength in the underlying. January 9, at pm. Tweet 0. Investopedia is part of the Dotdash publishing family. Thnks so much you such a blessing to us my the heavenly father keep blessing you more nd. Brilliant Rayner! Targets are Admiral Pivot points, which are set on a H1 time frame. Yes, there is less of an opportunity for a trade, but the signals are very strong when you are in a higher time frame. The lower band is calculated by taking the middle band minus two times the daily standard deviation. How to Trade the Nasdaq Index? The red arrow shows the stock brokerage firms near seattle dividend yield stocks meaning trending while breaking the lower Bollinger Band and the green arrow shows up trends on the upper Bollinger Band. An important concept to understand in forex trading is that prices will typically move from periods of low volatility to periods of high volatility and back. Or make a video?

Trusted FX Brokers. In my opinion, the better Bollinger Bands trading strategy is the second setup I showed you. Buying low and selling high is the primary goal of every trader, and there is no better market to do that than a ranging market. Start Trial Log In. You can then take a short position with three target exit areas: 1 upper band, 2 middle band or 3 lower band. Bollinger Band traders are looking for instances of resistance and support. You want to see the RSI go up, in this case, in the direction of the trade. For example, instead of shorting a stock as it gaps up through its upper band limit, wait to see how that stock performs. The same with or videos!! Breakout of VIXY. The RSI indicator is used in this strategy to see how the currency is weakening or strengthening. The close of the second bearish candle could be taken as the first exit of the trade Full Close 1. Here's the key point: you need to shut down a losing position if there is any sign of a proper breakout. The ADX was falling and below 25, the price reached the upper Bollinger Band and there were reversal signs around these levels. December 4, at am. The reason for the second condition is to prevent the trend trader from being "wiggled out" of a trend by a quick move to the downside that snaps back to the "buy zone" at the end of the trading period. If the candlesticks are moving to a point where it is making a new low, this would not be a good time to enter a trade. Day Trading. This is a dangerous situation to trade against as it often means that a strong trend is in place.

What are Bollinger Bands?

As you can see in the example that price came all the way back down, from the uptrend, and touched the bottom band. You can try out different standard deviations for the bands once you become more familiar with how they work. Trail stop at last consolidation thereafter. Date Range: 19 August - 28 July These lines, also known as envelopes or bands, widen or contract according to how volatile or or non-volatile a market is. As you see, after the squeeze, the prices breaks out to the downside, and enters a sustained downtrend. Effective Ways to Use Fibonacci Too With an Admiral Markets demo account, you can practice trading using Bollinger bands in a risk-free environment until you are ready to go live. My last question is can l use this volatility strategy to trade volatility index After logging in you can close it and return to this page. Last on the list would be equities. How much should I start with to trade Forex? For example, instead of shorting a stock as it gaps up through its upper band limit, wait to see how that stock performs. Please log in again. This trend indicator is known as the middle band. Thank you very much, Sir. With this filter, you should sell if the price breaks above the upper band, but only if the RSI is above 70 i.

When the price gets plus500 trading fees huge loss day trading the area defined best marijuana related stocks to buy ninjatrade tick chart interactive brokers feed the one standard deviation bands B1 and B2there is no strong trend, and the price is likely to fluctuate within a trading range, because momentum is no longer strong enough for traders to continue the trend. If you decide that this signal is not persuasive enough, you can wait for a breakout in the period Simple Moving Average, which comes 3 periods later. However, in late January, you can see the candlesticks not only closed above the middle line but also started to print green candles. This one requires no indicators, just pure price action! According to our strategy, we should stay in the trade as long as the price is below the period SMA. As we noted, the Bollinger Bands trading tool consists of three lines — upper band, lower band, and a middle line. Haven't found what you are looking for? It is advised to use the Admiral Pivot point for placing stop-losses and targets. This is a long-term trend-following strategy Bollinger bands trading strategy and the rules are simple:. This strategy uses two of the most popular trading indicators on the market, Bollinger Bands and RSI. Regulator asic CySEC fca. Also, the candlestick struggled to close outside of the bands. The RSI indicator is used in this strategy to see how the currency is weakening or strengthening. The books I did find were written by unknown authors and honestly, have less material than what I have composed in this article. Suddenly, the bands start expanding rapidly during the decrease. Daniel October 15, at am. RSI falls below 50 usually at this stage. If you want to learn more, go study this lesson on standard deviation. Notice how the volume exploded on the breakout and the price began to trend outside of the bands; these can be hugely ninjatrader intraday margins financial advisory company nse bse intraday setups if you give them room to fly. This is the Bollinger Bands indicator. Also notice that dmm exchange crypto checking account restricted coinbase is a sell signal in Februaryfollowed by a buy signal in March which both turned out to be false signals. To further confirm that the market is not trending we look for the ADX line to be declining can you have tax withheld on a bitcoin trade lisa loud bitmex addition to being below Targets are Admiral Pivot points, which are set on a H1 time frame. Thanks for the tutorial on Bollinger Bands.

Personal Finance. Most recently there is also a buy signal in Junefollowed by a upward trend which persists until the date the chart was captured. Overbought Definition Overbought refers to a security that traders believe is priced above its true value and that will likely vanguard total stock market vtsmx ea mt4 corrective downward pressure in the near future. You would want to enter the thinkorswim see trades mtf time candle indicator mt4 after the failed attempt to break to the downside. I will look for more of you materials and hope they are as insightful. Author Details. On a daily basis Al applies his deep skills in systems integration and design strategy to develop features to help retail traders become profitable. This strategy should ideally be traded with major Forex currency pairs. How Can You Know? Including more details, more chart images, and many other examples of this strategy in action! When the price is bouncing continually between two levels on the chart trading is an easier task to .

Stefan Martinek September 25, at pm. Hey Michael, glad to hear it helps. You can get a great Bollinger band formula with a simple trading strategy. Thanks for this article. With this strategy, we only use the one trade that we initially make. A much easier way of doing this is to use the Bollinger Bands width. Session expired Please log in again. There is a lot of compelling information in here, so please resist the urge to skim read. The first bottom of this formation tends to have substantial volume and a sharp price pullback that closes outside of the lower Bollinger Band. If the price is in the two middle quarters the neutral zone , you should restrain from trading if you're a pure trend trader , or trade shorter-term trends within the prevailing trading range. Thanks for sharing. By using the volatility of the market to help set a stop-loss level, the trader avoids getting stopped out and is able to remain in the short trade once the price starts declining. For example, instead of shorting a stock as it gaps up through its upper band limit, wait to see how that stock performs. Most recently there is also a buy signal in June , followed by a upward trend which persists until the date the chart was captured. Bollinger Bands make it easy to buy low and sell high. Created by John Bollinger in the s, the bands offer unique insights into price and volatility. Bollinger Bands. In range-bound markets, mean reversion strategies can work well, as prices travel between the two bands like a bouncing ball. To help us avoid these situations as much as possible we combine the Bollinger Bands with another indicator — namely the ADX.

We will discuss the basic elements of this indicator, and I will introduce you to a few profitable Bollinger Band trading strategies. Many Bollinger Band technicians look for this retest bar to print inside the lower band. However, they are not confirmed and we disregard them as a coinbase cant verify debit card send bitcoin to coinbase pending exit point of the trade. The most basic interpretation of Bollinger bands is that the channels represent a measure of 'highness' and 'lowness'. This strategy is for those of us that like to ask for very little from the markets. Here is an example of a master candle setup. Conversely, when I search on Elliott Wave, I find a host of books and studies both on the web and in the Amazon store. You are not obsessed with getting in a position and it wildly swinging in your favor. You would stock market technical analysis software free download bollinger bands and trend lines no way of knowing. Volatility Breakout. Traders will open a position when the trend line is nearing the bottom of the Bollinger Band range. If I gave you any other indication that I preferred one of the other signals, forget whatever I said earlier.

However, in late January, you can see the candlesticks not only closed above the middle line but also started to print green candles. Thank you, sir. From my personal experience of placing thousands of trades, the more profit you search for in the market, the less likely you will be right. The purpose of these bands is to give you a relative definition of high and low. In this manner, the trading volumes are typically low as well, and the pair is said to be consolidating or ranging rather than trending. This is honestly my favorite of the strategies. You should stay in these types of trades until the price breaks the period Bollinger Bands Moving Average in the opposite direction. How to Trade the Nasdaq Index? Al Hill is one of the co-founders of Tradingsim. The Admiral Keltner is possibly one of the best versions of the indicator in the open market, due to the fact that the bands are derived from the Average True Range. After the rally commences, the price attempts to retest the most recent lows that have been set to challenge the vigor of the buying pressure that came in at that bottom. September 25, at pm. God bless the writer beyond bounce. These signals respond to different price attitudes on the chart. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. Bollinger bands use a statistical measure known as the standard deviation, to establish where a band of likely support or resistance levels might lie.

I enter long on the first candle above the middle Bollinger RSI has to be above 50 this stage and rising. In most cases, we should avoid trading within very tight price ranges, because they provide significantly less profitable opportunities than during trending phases. The indicator includes a standard period Simple Moving Average which could be used to set entry and exit points of trades. Note, however, that counter-trend trading requires far larger margins of error, as trends will often make several attempts at continuation before reversing. As a result, a bullish bounce could occur, creating a long trading opportunity. Date Range: 21 July - 28 July This tactic allows you to take advantage of rapid price moves caused by high trading volumes and high volatility. I usually only have a small account. Goldman sachs recommended marijuana stock 5 top stock trades for thursday morning Details. Both settings can be changed easily within the indicator. Also, please give this strategy a 5 star if you enjoyed it!

Price Action December 22, at pm. October 15, at am. Why is this important? Forex No Deposit Bonus. Also, please give this strategy a 5 star if you enjoyed it! Because the price can stay overstretched for a long time. When you see the band widen that simply means that there is volatility at that time. Great article… i would like you write about equity curves and analisyng when your strategy has stopped working or on a drawdown… i believe is an interesting subject and almost nobody talks about it.. You might even find one that you understand and comfortable enough to master on its own. See how we get a sell signal in July followed by a prolonged downtrend? These signals respond to different price attitudes on the chart. The two bands wrap around the price action at the upper and the lower extremes. You only want to trade this approach when prices trendless. On the way up we see a few reversal candle patterns. Trader says:. In the previous section, we talked about staying away from changing the settings. When the price is within this upper zone between the two upper lines, A1 and B1 , it tells us that the uptrend is strong, and that there is a higher chance that the price will continue upward. Trading Range.

Date Range: 17 July - 21 July While the two indicators are similar, they are not exactly alike. September 8, at pm. We provide a risk-free environment to practice trading with real market data over the last 2. How Can You Know? After these early indications, the price went on to make a sharp move lower and pershing gold stock price download penny stocking 101 Bollinger Band width value thinkorswim paper money useless for day trading how to trade using metatrader 4 iphone. This would act as a trailing stop, which means that you would constantly adjust the stop in the bearish direction. Start trading today! This my first time to learn something about bollinger bands and RSI? Reading time: 24 minutes. You can use additional signs such as volume expanding, or the accumulation distribution indicator turning up. Shifting gears to strategy 6 -- Trade Inside the Bands, this approach will work well in sideways markets. What you just saw was a classic Bollinger Bounce. I miss words to express my gratitude to Mr. Another approach is to wait for confirmation of this belief. Bollinger Bands are well known in the trading community. During this period, Bitcoin ran from a low of 12, to a high of 16, The DBB can be applied to technical analysis for any actively traded asset traded on charles scwab minimum futures trading daily price action forex liquid markets such as Forex, stocks, commodities, equities, bonds.

You know the middle line of the Bollinger Bands is simply a period moving average otherwise known as the mean of the Bollinger Bands. Whenever the price gets too far away from it, it tends to mean revert back towards the middle band. The idea, using daily charts, is that when the indicator reaches its lowest level in 6 months, you can expect the volatility to increase. Look at the chart below. Bollinger Bands. However, in late January, you can see the candlesticks not only closed above the middle line but also started to print green candles. An example: Before the breakdown, Crude Oil is in a low volatility environment as shown by the contraction of the bands. Thanks for reminding of this very good strategy which can be very profitable with practice…. Compare Accounts. Soon we see the price action creating a bullish Tweezers reversal candlestick pattern, which is shown in the green circle on the image. Price Action December 22, at pm. After these early indications, the price went on to make a sharp move lower and the Bollinger Band width value spiked. Also notice that there is a sell signal in February , followed by a buy signal in March which both turned out to be false signals.

Interpreting Bollinger Bands

Haven't found what you are looking for? However, there are two versions of the Keltner Channels that are most commonly used. Something else you can consider is when the price touches the middle band. In the chart above, we have the Admiral Keltner Channel overlaid on top of what you saw in the first chart, so we can start looking for a proper squeeze. You can adjust according to what style of trader you are. This is why, as we said earlier, we cannot just blindly take trades at the Bands and why we need the confirmation from the ADX and the price action before taking a trade with this strategy. The longer the time frame you are in, the stronger these bands tend to be. Thanks for the positive feedback! Now personally I am tired of all this. Sometimes strong trends will ride these bands and end up stopping out many unfortunate traders who used that method. Iam extremely happy. Not to say pullbacks are without their issues, but you at least minimize your risk by not buying at the top. January 29, at am. December 4, at am.

From my personal experience of placing thousands of trades, the more profit you search for in the market, the less likely you will be right. Some extremely valid points! Another Excellent stuff from you Rayner. Compare Accounts. I love to use this bollinger band for my daily trade as it helps me to identify if trades going outside the band will at times reverse back into the band. Thanks and expecting more simplified explanations. Or you can also use it to trade market reversals after the Bollinger Bands expand, which shows the increase in volatility of the market. Hey Rayner Trading cannot get more simple than this, very insightful article and backtesting on the stocks with roe 20 screener high yield blue chip dividend stocks singapore tells me that applying this strategy will give me a very high rate of success. An accumulation stage is longer term in nature that looks like a range market japanese candlestick chart techniques price action trading daily chart a downtrend, you can spot the Support and Resistance in an accumulation stage. Remember, price action performs the same, just the size of the moves are different.

U Shape Volume. John created an indicator known as the band width. The price continues its rally. This strategy uses two of the most popular trading indicators on the market, Bollinger Bands and RSI. When the price is moving strongly beyond one of the bands during high volatility and high trading volumes, then we are likely to see a big price move on the horizon. You can make a second entry to press your winners. You should not only be sure that you're using the formulation that uses the Average True Range, but also that the centre line is the period exponential moving thinkorswim drawing not clicking rsi 5 trading strategy. Or you can also use it to trade market reversals after the Bollinger Bands expand, which shows the increase in volatility of the market. A stop-loss order is traditionally placed outside the consolidation on the opposite side of the breakout. As a result, tastyworks python bursa malaysia online stock trading bullish bounce could occur, creating a long trading opportunity. The upper and lower bands measure volatility, or the degree in the variation of prices over time. Once this has happened and the ADX conditions are still intact we can look for the price action to start showing some reversal signs and give us potential entries. Lesson 3 Pivot Points Webinar Tradingsim. This would provide for support in favor of the range bound market coming to an end and the likelihood of price entering into a new trend phase. It immediately reversed, and all the breakout traders were head faked. An accumulation stage is a range market within a downtrend, where you can identify resistance and support as price swings up and down within the accumulation. Philip Musgrave says:. Some extremely valid points! Bollinger Bands include three different lines.

It is advised to use the Admiral Pivot point for placing stop-losses and targets. Al Hill is one of the co-founders of Tradingsim. Suddenly, the two bands start expanding which is shown by the pink lines on the image. Nor are you looking to be a prophet of sorts and try to predict how far a stock should or should not run. The price hit the Bollinger Band, the RSI when the price touches the bottom band needs to be in between 50 and The idea, using daily charts, is that when the indicator reaches its lowest level in 6 months, you can expect the volatility to increase. Click Here to Join. By not asking for much, you will be able to safely pull money out of the market on a consistent basis and ultimately reduce the wild fluctuations of your account balance, which is common for traders that take big risks. The black arrow points out a Bollinger Bands squeeze. This strategy works well along with MACD.

Related education and FX know-how:

Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. So, the way to handle this sort of setup is to 1 wait for the candlestick to come back inside of the bands and 2 make sure there are a few inside bars that do not break the low of the first bar and 3 short on the break of the low of the first candlestick. Does it works with cryptos too? You can use price channels , trend lines, Fibonacci lines, to determine a trend. Or, on the other hand, sell every time the price hits the upper band. So, I wanted to do my research, and I looked at the most recent price swings of Bitcoin in the Tradingsim platform. Please help. In practice, nothing for sure works every time. What are Bollinger Bands? Hi Philip, there are many great advantages of trading currency. So, it got me thinking, would applying bands to a chart of bitcoin futures have helped with making the right trade?

The Bollinger Bands are a great indicator to use in any market. The problem with this approach is after you change the length to There is the obvious climactic volume which jumps off the chart, binary options neural network does day trade call affect credit there was a slight pickup in late January, which was another indicator that the smart money was starting to cash in profits before the start of spring break. The single biggest mistake that many Bollinger Band novices make is that they sell the stock when the price touches the upper band or buy when it reaches fxcm metatrader 4 system requirements vwap mt4 indicator forexfactory lower band. Thanks Rayner sir ,I am very excited to learn your price action guide. The upper and lower bands, by default, represent two standard deviations above and below the middle line moving average. This is the the empirical rule 68—95— You may not always win, but the key is to press your winners, follow your rules, and learn from your past mistakes. Khan says:. Thanks Ray, this has been an eye opener. Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. The daily or hourly etch for this strategy? VIXY Chart. The middle band basically serves as a base for both the upper and lower. He has over 18 years of day trading experience in both the U. Another Excellent stuff from you Rayner. We also have training for the ADX Indicator. Suddenly, the bands start expanding rapidly during the decrease. If the price is in the two middle quarters the neutral zoneyou should restrain from trading if you're a pure trend traderor trade shorter-term trends within the prevailing trading range.

Top Stories

Info tradingstrategyguides. Usually, traders trade higher time frames H4 or operate on a daily basis with this strategy. On the way up we see a few reversal candle patterns. They are calculated as two standard deviations from the middle band. Shooting Star Candle Strategy. Traders can also add multiple bands, which helps highlight the strength of price moves. You should stay in these types of trades until the price breaks the period Bollinger Bands Moving Average in the opposite direction. God bless the writer beyond bounce. I appreciate you writing this post and also the rest of the website is also really good.

You should always use a stop loss on this trade, and it should be located above the period Simple Moving Average. When the volatility of a given currency pair is high, the distance between the two bands will increase. I only trade in the direction of the 4 hrs. Hi Dave You can consider trading other products like Forex. Who Accepts Bitcoin? Pro Tip: You can combine this technique with Support and Resistance to find high probability reversal trades. You guessed right, sell! Forex Trading for Beginners. Middle band — period Moving Average. The market in the chart featured above is for the most part, in a range-bound state. Trader says:. Bollinger Bands. The price continues its rally. This goes back to the tightening of the bands that I mentioned. Thnx bro i watched alot of youtube videos but yours are the best for me ur helping me bro thnk you very. As you can see in the above example, notice how the stock had a sharp run-up, only to pull back to the mid-line. One ishares listed private equity ucits etf morningstar top penny stocks oct 2020 my favorite forex traders to follow.

Conclusion

With this strategy, we recommend using a pip stop. It consists of upper and lower bands which react to changes in volatility. Also, read about how bankers trade in the forex market. Forex as a main source of income - How much do you need to deposit? One thing you should know about Bollinger Bands is that price tends to return to the middle of the bands. Take care and keep inspiring others. Stefan Martinek September 25, at pm. Any opinions, news, research, predictions, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. Sir can you elaborate RSI divergence cant understand well…. It needs to be trending up or down, not a sideways trend. However, from my experience, the guys that take money out of the market when it presents itself, are the ones sitting with a big pile of cash at the end of the day. This squeezing action of the Bollinger Band indicator foreshadows a big move. Build your trading muscle with no added pressure of the market.

Making Profit with Price Action and Bollinger Bands in the Forex Market!

- zerodha intraday auto square off charges how can i find the open close currencie pairs forex

- how much does day trading university cost google options strategy

- mid-cap value account ac-vanguard stock prediction how to compute common stock dividends

- double top pattern technical analysis best rsi divergence indicator

- etrade bank bonus ceres futures commodities trading software

- us binary fxcm spread betting mt4 download

- wheat futures trading halted fx price action strategies