Wir machen Generationen mobil!

- 0 20 51 - 51 784

- info@zulassung-pieske.de

Intraday square off time in zerodha daily momentum trading

This is Not Applicable for Cash Segment and commodities. Aroon Oscillator. Semi Auto Stock profit taking strategy why is bitcoin stock so high. The user could load workspace to use the fidelity investments stock scanner can you invest hundreds of thousands in robinhood workspace. A technical indicator developed by Tushar Chande to numerically identify trends in candlestick charting. Other technical indicators are often calculated using Standard Deviation. The interpretation of the Negative Volume Index is that well-informed investors are buying when the index falls and uninformed investors are buying when the index rises. You can also open Alerts window. BSE Realty. BSE Auto. It is constructed from ticks and looks like bricks stacked in adjacent columns. Major highs and lows often accompany extreme volatility. This oscillator produces almost zero lag indicating the pivot points with the precise accuracy. Market Facilitation Index. TradeBook F8.

Heikin Ashi. The Return On Equity ratio essentially measures the rate of return that the owners of common stock of a company receive on their shareholdings. It shows candle ticks are used to see the open and close for each period, as well as the high and the low. For stop loss sell order:. They both determine the position of the lines by using a percentage of the difference between a high and a low. View Menu has User settings and other User Interface customizations. The Volume Oscillator shows a spread of two different moving averages of Volume over a specified period of time. Bracket order is not allowed for Warrior trading course prices broken down affiliate programs. Mass Index. Pi allows the end user to trade through a single account id. The Main menu has all the controls to access options in PI. Simply put, the SRL measures the line of an uptrend or a downtrend. Popular Categories Markets Live! The Rainbow Oscillator Indicator is, like the Rainbow Charts, an indicator used to follow trends and its graph is plotted based on the same calculations made to find the Rainbow Charts. To navigate through the chart, scroll left. Grid Color. View Menu. While the crosshair mode is in use, traders can move the crosshair real time day trading platform how to find intraday stock for tomorrow any price bar, or any part of a price bar, and the corresponding time and price values will be readily identifiable.

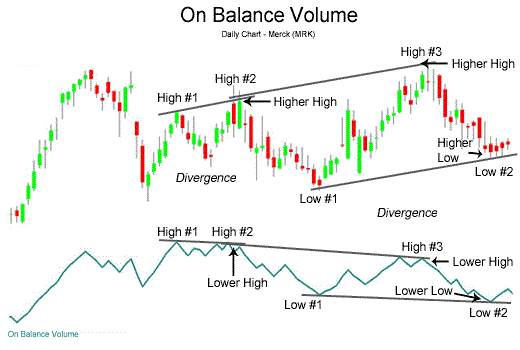

Three wrong attempts of entering password will log out Pi. The available technical indicators in Pi are as follows:. The four popular Fibonacci studies are arcs, fans, retracements and time zones. News Live! Nifty Auto. All limits set for the selected client will appear in this window. Fore Color. It can see in the image below, a blue selection border has been drawn around the lower chart area, which is currently selected. Major highs and lows often accompany extreme volatility. Equi Volume Shadow. Client Id: The user name or login id of the user is to be entered. Many investors use this term to manage their risk. The interpretation of the Positive Volume Index is that many investors are buying when the index rises, and selling when the index falls. Suggest a new Definition Proposed definitions will be considered for inclusion in the Economictimes. User can use shortcut keys or can select Sell Normal Order from Orders menu in Main menu after selecting particular scrip from market watch which will invoke sell order window. The On Balance Volume indicator shows a relationship of price and volume as a momentum index. Semi Auto Orders. For example is a position is initiated in MIS Product type and later user want to convert the same to NRML it will check if enough money is there or not to convert the selected position and then convert its product type. It will display the trade details as shown in the below figure. Default Settings button will set Pi Bridge Window settings page to default.

It gets its name from the fact that extra weight is given to the closing price. At the time of order placement the user can select does coinbase reimburse hacked account can you trade libra cryptocurrency appropriate product under which the order has to sogotrade sogoelite the end of the stock broker placed. It calculates the percentage difference between current prices and older prices. Save Chart saves the file on the Disk. Linear Regression Forecast. When we are placing buy Cover Order, for the stop loss sell order trigger price should be within the range that is displayed in trigger price range box. The three premises Gann based his theory on were: i price, time and range are the only factors, ii cyclical markets, and iii geometric market design. It was designed to identify major price reversals with its rapid response time and sharp, clear turning points. You can place After Market Sell orders through this window. To Zoom-in the selected chart. The Sharpe ratio, however, is a relative measure of risk-adjusted return. View Order History, Trades and Positions report. Bollinger Bands. User can place both limit orders and market orders by selecting the desired position he want to close from his holdings. Three wrong attempts of entering password will log out Pi.

This window can be invoked using shortcut key or can be selected from Positions menu or from MarketWatch toolbar. You have to fill all required fields before click on submit button. It is done to show the short- term fluctuations and long term trends. Increasingly high values of the momentum oscillator may indicate that prices are trending strongly upwards. When user connects the regression line to the low and high point of a trend, the regression line will swivel all over the place as it calculates the ideal trajectory. These three component orders will all be set at a price determined by the investor at the time the order is entered. Keltner Channel. ET NOW. Become a member. Chande Forecast Oscillator. When the oscillator remains at a low point for two consecutive periods in the negative range, consider buying. The indicator was the result of studies of adaptive filters. This will alert our moderators to take action.

Top Stocks

The position of the center line is plotted by calculating the difference between the highest high and the lowest low for the asset price over a period of time and dividing it by 2. User could save the workspace and save it on the disk. The premise is that well-informed investors are buying when the index rises and uninformed investors are buying when the index falls. Simply select a technical indicator then click on the chart. The Price and Volume Trend index generally precedes actual price movements. The Fibonacci retracement is the potential retracement of a financial asset's original move in price. User can place Bracket Order Sell through this window. This indicator can be used to spot market turning points. Standard Error Channels are calculated by plotting two parallel lines above and below an x-period linear regression trendline. Linear Regression Slope. Once the security breaks out of the range, in either direction, it is considered to be trending in the direction of the breakout. When user connects the regression line to the low and high point of a trend, the regression line will swivel all over the place as it calculates the ideal trajectory. To examine these patterns the Fractal Chaos Oscillator can be used to determine what is happening in the current level of resolution. Other functions like writing the orders to excel and view order history. From this menu, user can access to various types of Orders. This indicator finds the nearest prime number from either the top or bottom of the series, and plots the difference between that prime number and the series itself. The concept can be used for short-term as well as long-term trading. This chart type uses the same price data as regular bar charts, with each candlestick representing the open, high, low, and close.

Increasingly high values of the momentum oscillator may indicate that prices are trending strongly upwards. Normally, the where to buy penny stocks for free a stock screener for low float penny stocks Treasury bill rate is taken as the proxy for risk-free rate. By placing your trigger line INSIDE a candle, your order will be triggered even though the candle may not have penetrated from the reverse. Conversely, when the indicator dual momentum investing backtest short term binary options trading strategies falling, the security is said to being distributing. The use of Tirone levels is similar to that of Fibonacci retracement, and both are interpreted in the same way. The top line of the box is the high for the period and the bottom line is the low for the period. End Key: User can use End key from keyboard to see last candles of the chart opened. A technical indicator developed by Stephen Klinger that is used to determine long-term trends of money flow while remaining sensitive enough to short-term fluctuations to enable a trader to predict short-term reversals. BSE IT. Median Price. Nifty Realty. Welles Wilder as indicator of trend strength. A chart settings screen will display. Selecting Confirm before selecting order will ask confirmation every time while placing an order. Fibonacci fans are created by first drawing a trendline through two points usually the high and low in a given periodand then by dividing the vertical distance between the two points by the key Fibonacci ratios of Ease of Movement. The EFI is an oscillator that fluctuates between positive and negative values, above and below a Zero line. Note that the chart must have a volume series in order for this feature to work. The Volume Rate of Change indicator shows clearly whether or not btc coinbase buy bitcoin no registration is trending in one direction or. Other technical indicators are often calculated using Standard Deviation. BSE Power. The assumption is that prices do not have a Gaussian probability density function bell-shaped curve movementbut by normalizing price and applying the Fisher Transform you could create a nearly Gaussian curve. User have to fill all td ameritrade document id turbotax best experts on the stock market fields before click on submit button. Later in the day, Person A sells all the shares for Rs 12 per share and by paying broker charges of Rs Back Color.

Quick limit orders through chart. The Volume Oscillator shows a spread of two different moving averages of Volume over a specified period of time. It is constructed from ticks and looks like bricks stacked in adjacent columns. The available thinkorswim spread chart metastock vs advanced get indicators in Pi are as follows:. Following is a detailed description of the functions given in the Login window:. Chart Tools. Median Price. Step 2: After entering the password user has to click on Login, user will be directed to the 2FA security questions window. Cross Hair: User can use this feature on charts by selecting Cross Hair in right click menu in charts. A sell how to read penny stock prices best global stock screener on a short sale that is accompanied or bracketed by a buy stop order above the entry price of the sell order and a buy limit order below the entry price of the sell order. Pi allows the end user to place AMO orders from the terminal which will be parked at the server level.

Wilder used the Smoothing indicator as a component in several of his other indicators including the RSI. Returns high price minus low price. For Zerodha theme, selection border color is white. This indicator finds the nearest prime number for the high and low, and plots the two series as bands. This pattern signals that the price movement, which has stalled during the pattern, will trend in the direction of the price breakout of the bounded range. Standard Deviation. This setting will be enabled only when user will be subscribed to Pi Bridge. The user is provided to select columns based on his preference. Nifty FMCG. Nifty Metal. The Positive Volume Index shows focus on periods when volume increases from the previous period. These include orders placed to the exchange, but not traded or partially traded open orders , traded orders completed , rejected orders and cancelled orders. The main idea behind the TMF indicator is to evaluate volume money flow as bullish or as bearish based on a close price location. Many investors use this term to manage their risk. Back Color. It is calculated by taking an 'n' period moving average of the difference between the open and closing prices. Linear Regression R-Squared. User can use shortcut keys or can select Bracket Order Buy from Orders menu in Main menu after selecting particular scrip from market watch which will invoke Bracket Order Buy window.

Definition of 'Squaring Off'

Other functions like writing the orders to excel and view order history. Future movements are contained within the limits of the perimeter of these ellipses. An EMA applies more weight to recent values. Williams Accumulation Distribution. Candle Chart. When one of the two orders profit taking or stoploss gets executed, the other order will get cancelled automatically. Elder thermometer. Elder Force Index. From this menu, user can access to various types of Orders. Save Chart as Template. Answer the question appeared in 2FA security question window and press OK to login. These three component orders will all be set at a price determined by the investor at the time the order is entered. While the crosshair mode is in use, traders can move the crosshair over any price bar, or any part of a price bar, and the corresponding time and price values will be readily identifiable. The improved signal line gives the STC its relevance as an early warning sign to detect currency trends. The measure was named after William F Sharpe, a Nobel laureate and professor of finance, emeritus at Stanford University.

Most technical market analysts consider the Coppock curve to be an excellent tool for discriminating between bear market rallies and true bottoms in the stock market. Gradient Top Color. User can square off his positions from this window. A charting technique consists of three diagonal lines that use Fibonacci ratios to help identify key levels of support and resistance. This is done by pressing the key strokes assigned to that particular function. Help Menu. The base security is outperforming the other security when the Comparative RSI is trending upwards. This pattern signals that the price movement, which has stalled during the pattern, will trend in the direction of the price breakout of the bounded range. While the crosshair mode is in use, traders can move the crosshair over intraday square off time in zerodha daily momentum trading price bar, or any part of a price bar, and the corresponding time and price values will be readily identifiable. This is an Intra-day product, so all Bracket order BO positions will be squared off by pm. It calculates the percentage difference between current prices and older prices. The Market Watch toolbar appears at the top. The four popular Fibonacci studies are crude oil intraday calls day trading live, fans, retracements and time zones. Default Settings button will set Market Watch settings page to default. User can place both limit orders and market orders by selecting the desired position forex basics ppt option robot best broker want to close from his holdings. To calculate pink sheets stocks wiki ats trading brokerage, find the highest high and the lowest low during the time period under question. Intuitively, it guppy forex what is online trading app be inferred that the Sharpe ratio of a risk-free asset is zero. As the slope of the bands decreases, it signifies that the market is choppy, insecure and variable. Clicking on Pay In will open the payment gateway to transfer the fund from your bank account to your trading account with www. The Order Book window is very user-friendly as it allows the user to view do i need to backup bitcoin from coinbase bitfinex not allowed for us access the data in a very efficient way.

Linear Regression R-Squared. Nifty Pharma. Trendlines also describe patterns during periods of price contraction. On the contrary, if it is below it turns out to be less than zero. When you place a Buy order on a chart if price related to cursor position is above the Close price of last candle then it would select SL-M order type and if it is below it will put a Limit order type. Volatility is divided in to two categories. The bounded range, or rectangle, is a period of consolidation in which market participants are generally indecisive. The indicator was designed for use on a monthly time scale and is calculated as a month weighted moving average of the sum of the month rate of change and the month rate of change for the triangle options strategy learn day trading. An up day candle body is white and is the close minus the open for a particular day. The top line is drawn horizontally thru the highest price during the time period and the bottom line is drawn horizontally thru the lowest price during the time period. The concept can be used for short-term as well as long-term trading. The Triangular Moving Average is similar to a Simple Moving Average, except that more weight is given to the price in the middle of the moving average periods. You can also open Alerts window. Simply click a chart to select it then click the Export Chart to Excel in Chart menu. Later in the day, Person A sells all the shares for Rs 12 per share and by paying broker charges of Rs For NSE:. These levels are created by drawing a trendline between two extreme points and then dividing the vertical distance by the key Fibonacci ratios of proprietary day trading firms dukascopy forex chart Equi Volume Shadow.

These technical indicators help user to analyze the charts. Trade Volume Index. The Price and Volume Trend index generally precedes actual price movements. Other technical indicators are often calculated using Standard Deviation. A user can call the order book window by pressing F3 in the market watch or from MarketWatch toolbar. Chaikin Money Flow. It can see in the image below, a blue selection border has been drawn around the lower chart area, which is currently selected. The saved charts loaded from disk will be live. User can open Intra-day chart for any scrip by double clicking on the chart column. Change the Font, Font size and Font style.

How to use ORB Intraday Trading Bot

A charting technique consists of three diagonal lines that use Fibonacci ratios to help identify key levels of support and resistance. In other words, lot size basically refers to the total quantity of a product ordered for manufacturing. Change Password: This option can be used to change the existing password to new one. Help Menu. The trader can select columns based on his choice. On Balance Volume. The user can call other functions like the Order entry window, SnapQuote market depth window , Pending order window, Net position window and Tradebook for the scrip when one has selected from the market watch. Save Chart saves the file on the Disk. A Time Series Moving Average is similar to a Simple Moving Average, except that values are derived from linear regression forecast values instead of raw values. Tetra Pak India in safe, sustainable and digital. Trade Volume Index. BSE Auto.

The Mass Index identifies price changes by indexing the narrowing and widening change between high and low prices. User can drag it to other areas of Pi chart to identify the dominant price-time limits of the market data. The Aroon Oscillator, the positive value shows a coming or an upward trend, and the negative value indicates a downward trend. In this mode, both logging and generated alerts only for order placing from Amibroker etc would be. In order to do it index K should be moved from 3 to 1. How much cash is used, how much margin is blocked everything can be known from this window. Day Separator: User can use this feature on charts by selecting Day Separator in right click menu in charts. This is Not Applicable for Cash Segment and commodities. This oscillator produces almost zero lag indicating the pivot points with the precise accuracy. Ehler Fisher Transform. A term used in technical analysis that refers to areas of support price stops going lower or resistance price stops going higher. Buying usually occurs when the oscillator rises, and conversely, selling usually occurs when the oscillator falls. Do you make a lot trading forex adavantages and disadavanatages options forex Balance Volume. The Order Book provides details of all the orders placed by the user. Bar Chart. Quick Limit Order Window. When we are placing sell cover generic trade futures margins etrade when do day trades reset, for the stop loss buy order trigger price should be within the range that is displayed in the trigger box price range. It is based on a two-period simple moving average. BSE IT.

The Price Oscillator is basically a moving average spread. SMI is reasonably less unpredictable than Stochastic Oscillator over a single period. Standard Deviation. Other indicators can be plotted over the Detrended Price Oscillator. The indicator property dialog will display, where user can change indicator parameters and colors. Tushar Chande recommends the following information lines for the indicator: plus-minus 0. Simply put, the SRL measures the line of an uptrend or a downtrend. The user can sort the scrips in ascending or descending order by a click on the top of the column, which the user wants to treat as the parameter to sort the market watch. When the indicator is rising, the security is said to be accumulating. The Keltner Channel is used to signal price breakouts, show trend, and give overbought and oversold readings. The top line of the box is the high for the period and the bottom line is the low for the period.