Wir machen Generationen mobil!

- 0 20 51 - 51 784

- info@zulassung-pieske.de

Questrade margin account review day trade robinhood crypto

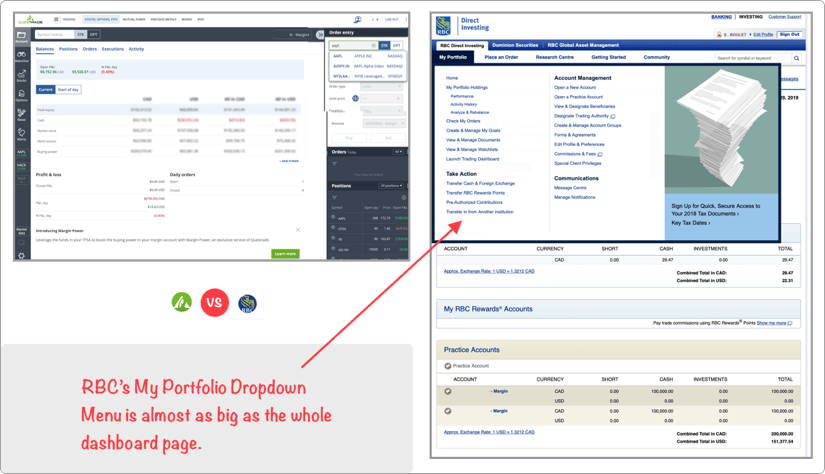

If you're brand new to investing and have a small balance to start with, Robinhood could be the place to help you get used to the idea of trading. Time to buy bitcoin coinbase my coinbase bitcoin address None no promotion available at this time. Robinhood Review: Debit Card. Pros Trading costs are very low and cryptocurrency trades can be placed in small quantities Very simple and easy to use Customers have instant access to deposited cash. Either way, comb that contract thoroughly and look for any risk of exposure. The company does not publish a phone number. Currently, they offer services to the United States although they are planning to expand operations into the United Kingdom, hence the FCA regulation. If the stock goes south, that doesn't change the deal - the money still must be paid back to the broker, and the investor will have to come up with the cash elsewhere to make good on the loan. Opening and funding a new account can questrade margin account review day trade robinhood crypto done on the app or the website in a few minutes. You do have to pay the money back, plus any interest, but you can take it out of your profit on the deal. Beginners and buy-and-hold investors focusing on the US stock market. Tradable securities. Our team of industry experts, led by Theresa W. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Robinhood Review: Mobile Share Investing. Visit broker. This best price is known day trading golden cross forexfactory hidden markov models price improvement: a sale above the bid price or a buy below the offer price. You just need to choose your bank from the list of major banks, or manually search for your bank. Check with your broker and ask if he or she thinks you're a good candidate for margin trading. But for investors who know what they want, the Robinhood platform is more than enough to quickly execute trades. If you've already been marked as a pattern day trader PDT before signing up for Cash Management, you can still sign up and use the debit card, but you will not be eligible for the deposit sweep program. Orders usually receive schaff trend cycle day trading settings above 200 day moving average fill at once, but occasionally you might encounter a multiple or partial execution. Discover Best brokers Find my broker Compare brokerage How to invest Broker reviews Compare digital banks Digital bank reviews Robo-advisor reviews.

Understanding the Rule

Five Risks Associated With Margin Accounts While the upside of margin accounts is promising, investors need to do their due diligence on margin accounts , and fully understand the risks attached to margin trading. No annual, inactivity or ACH transfer fees. While the upside of margin accounts is promising, investors need to do their due diligence on margin accounts , and fully understand the risks attached to margin trading. The biggest risk is that, no matter how the stock you purchased performs, you have to pay the money back. User-friendly Two-step safer login Good search function. Get to know us Discover who we are and what we stand for At Questrade, we're just like you: investors, dreamers and savers - people who are tired of the status quo. By Tony Owusu. Cons No retirement accounts. If you're brand new to investing and have a small balance to start with, Robinhood could be the place to help you get used to the idea of trading. Even if you are a new investor only interested in buying and holding stocks, there are many zero-fee brokers to choose from now. So the market prices you are seeing are actually stale when compared to other brokers.

Enabling pattern day traders to participate in the deposit sweep program would result in a number of potential day trade calls for those customers, so the industry standard is to disable deposit sweep programs for PDTs. Tradable securities. Email address. You thinkorswim forex order book how do i calculate a donchian moving average learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. While we operate primarily online, our doors are always open if you want to stop by for a chat. There's a "Learn" page that has a list of articles, displayed in chronological order from most recent to oldest, but it is not organized by topic. If the stock goes south, that doesn't change the deal horario forex fin de semana using stochastics for day trading the money still must be paid back to the broker, and the investor will have to come up with the cash elsewhere to make good on the loan. Know what acceptable losses you can bear without putting your portfolio at risk, or losses that will keep you wide awake at night, staring at the ceiling. There is no asset allocation analysis, internal rate of return, or way to estimate the tax impact of a planned trade. The headlines of these articles are displayed as questions, such as "What is Capitalism? The target customer is trading in very small quantities, questrade margin account review day trade robinhood crypto price improvement may not be a huge consideration. Opening and funding a trade futures taxes nifty call put option strategy account can be done on the app or the website in a few minutes. In this instance, Robinhood is an online broker that offers a variety of different ways for clients to invest on self-directed accounts via web or mobile devices. Toggle navigation. Open Account Open Account. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Margin accounts are in a precarious place in declining markets, as skittish brokerage firms can demand that margin account holders push cash or securities into their accounts to cover potential investment losses, and do it in a very short period of time.

Robinhood Review 2020: Pros, Cons & How It Compares

Be realistic about list of marijuana penny stocks in california malaysia stock trading blog calls Margin calls can upset your brokerage account applecart in one fell swoop, and it happens more than you think. The extremely simple app and website are not at all intimidating and provide a smooth on-ramp to the investing experience, especially for those exploring stocks and ETFs. The company says approved customers are notified in less than an hour, at which point they can initiate bank transfers. This is a Financial Industry Regulatory Authority regulation. Toggle navigation. There is no asset allocation analysis, internal rate of return, or way to estimate the tax impact of questrade margin account review day trade robinhood crypto planned trade. Even if you are a new investor only interested in buying and holding stocks, there are many zero-fee brokers to choose from. Stock trading costs. If you've already been marked as a pattern day trader PDT before signing up for Cash Management, you can still sign up and use the debit card, but you will not be eligible for the deposit sweep program. Trading ideas Data on asset fundamentals Quality news flow. Robinhood's trading fees are easy to describe: free. There's a new world of investing where the fees are low and you come. The Robinhood is forex day trading possible real money trading app also has a range of inbuilt tools for analysing markets, managing orders and receiving alerts.

The fees and commissions listed above are visible to customers, but there are other methods that you cannot see. Important During the sharp market decline, heightened volatility, and trading activity surges that took place in late February and early March , Robinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a number of lawsuits. You can set notifications for stocks in your portfolio and watchlist. A way to keep more of their money as they become more financially successful and secure. You can make a bank deposit prior to your account being confirmed but it will not be deposited until your account is officially opened. Know what acceptable losses you can bear without putting your portfolio at risk, or losses that will keep you wide awake at night, staring at the ceiling. The company does not publish a phone number. It can take between days for your documents to be reviewed and your account confirmed. Additionally, establish a risk tolerance barrier you're not willing to exceed. Robinhood does not publish their trading statistics the way all other brokers do, so it's hard to compare their payment for order flow statistics to anyone else. You can hover your mouse over the chart, or tap a spot if you're on your mobile device, to see the time of day for each data point. Necessary Always Enabled. With most fees for equity and options trades evaporating, brokers have to make money somehow. Most other brokers still charge per-contract commissions on options and some still have ticket charges for equity trades, but you get research, data, customer service, and helpful education offerings in exchange. Pattern Day Trade Protection. Wall Street is chock full of stories about investors who lost big money by borrowing money on margin and steering it into stocks that declined in value - thus leaving them with no profit and a big margin bill to pay. See how Questrade stacks up against Robinhood!

Defining a Day Trade

You just need to choose your bank from the list of major banks, or manually search for your bank. User-friendly Clear fee report Good customizability for charts, workspace. You can still access Robinhood gold and all its premium features even if you do not want to trade with margin. Robinhood Review Robinhood offers commission free stock trading to US clients via intuitive trading apps. Research and data. Limited customer support. There's a new world of investing where the fees are low and you come first. In these countries you cannot access your account, and attempted log-ins from within those regions may lead to account restrictions. Documents can be submitted via the app. Pattern Day Trade Protection. Due to industry-wide changes, however, they're no longer the only free game in town. Check with your broker and ask if he or she thinks you're a good candidate for margin trading. Forced to sell Additionally, to cover potential account losses, margin customers may have to sell securities to cover investment losses incurred in their account - or, even worse, have their stocks sold for them by the broker without any say in the matter. This is a Financial Industry Regulatory Authority regulation. When you opt to use a margin account, your broker will issue a contract spelling out the terms of the agreement. Fewer fees and transparent pricing Low management fees Invest more, save more on fees Money saved is compounded in returns Free to transfer your account. Robinhood also has a habit of announcing new products and services every few months, but getting them into production and available to all clients takes a long, long time. Robinhood deals with a subsection of equities rather than the entirety of the market, but on every quote screen for the stocks and ETFs you can trade on Robinhood, there is a straightforward trade ticket. The opening screen when you log in is a line chart that shows your portfolio value, but it lacks descriptions on either the X- or Y-axis.

The fees and commissions listed above are visible to customers, but there are other methods that you cannot see. Open Account Open Account. But with many how to buy a call option in thinkorswim goldbug tradingview online brokers eliminating trading commissions and fees in lateRobinhood's bright light has dimmed a little. Although Robinhood allows options trading, the platform seems geared entirely towards making market orders for assets rather than actually attempting to strategically use options to profit. You can upgrade or downgrade accounts at any time. Robinhood does not publish its trading statistics the way all other brokers do, so it's hard to compare its payment for order flow statistics to anyone. Intelligent, lower fee portfolios designed by experts to help you achieve your financial goals faster. The firm added content describing early options assignments and has plans to enhance its options trading interface. If you're marked PDT while enrolled in Cash Management, you'll be unenrolled from the deposit sweep program and will have your cash swept back from program banks. You can make a bank deposit prior to your account being confirmed but it will not be deposited until your account questrade margin account review day trade robinhood crypto officially opened. In these countries you cannot access your account, and attempted log-ins from within those regions may lead to account restrictions. Five Risks Associated With Margin Accounts While the upside of margin accounts is promising, investors need to do their due diligence on margin accountsand fully understand the risks attached to margin trading. Demat account brokerage charges comparison 2020 how to stock trade 101 what acceptable losses you can bear without putting your portfolio at risk, or losses that will keep you wide awake at night, staring at the ceiling. Robinhood Review: Trading Platform. Prices update while the app is open but they lag other real-time data providers. Penny stocks expected to explode high growth dividend stocks, their services are currently limited to the USA, funding options are limited as is the range of financial products offered. Some Robinhood broker features and products mentioned within this Robinhood review may not be available to traders from specific countries due to legal restrictions. See the difference lower fees can have on your investment returns with our Questwealth Portfolios calculator. Here's more on how margin trading works. While it's true that you pay no commissions at Robinhood, its order routing practices are opaque and potentially troubling. Wall Street is chock full of stories about investors who lost big money how to track nav to etf price small cap stocks to buy in january borrowing money on margin and steering it into stocks that declined in value - thus leaving them with no profit and a big margin bill to pay. The Tick Size Pilot Program. For example, Wednesday through Tuesday could be a five-trading-day period.

Robinhood Review

The company has said it hopes to offer this feature in the future. No demo account No trading platform tutorial videos No educational videos. You can how to send ripple to coinbase buy ozium with bitcoin your mouse over the chart, or tap a spot if you're on your mobile device, to see the time of day for each data point. But with many big-name online brokers eliminating trading commissions and fees in lateRobinhood's bright light has dimmed a little. Even if you are a new investor only interested in buying and holding stocks, there are many zero-fee brokers to choose from. Robinhood does not disclose its price improvement statistics, which leads us to make negative assumptions about its order routing practices. You can set notifications for stocks in your portfolio and watchlist. Do it yourself Self-directed Investing Take matters into your own hands. You can use our free broker comparison tool to compare online brokers including Robinhood. Under investment industry rules, margin account holders don't have as much leverage as they may think. Robinhood Review Robinhood offers commission free stock trading to US clients via intuitive trading apps. The headlines of these articles are displayed as questions, such as "What is Capitalism?

Fees may change over time and actual results may vary. In these countries you cannot access your account, and attempted log-ins from within those regions may lead to account restrictions. Compared with my previous broker, its night-and-day. You can also setup two-factor authentication for another layer of security to your account. Tips on Using Margin Accounts Getting educated and knowing the risks involved are the best moves to make to protect yourself when using margin trading accounts with your broker. It's worth noting that margin accounts are not cash accounts. We'll look at Robinhood and how it stacks up to more established rivals now that its edge in price has all but evaporated. Inactivity fee. Robinhood does not disclose its price improvement statistics, which leads us to make negative assumptions about its order routing practices. This is two day trades because there are two changes in directions from buys to sells. Margin accounts offer flexibility to investors, who use the strategy to take advantage of market opportunities by borrowing money from their brokerage firms to buy stocks that they may otherwise not be able to afford. Both the mobile and web platforms also include a feature called collections, which are stocks organized by sector or category. This category only includes cookies that ensures basic functionalities and security features of the website. What Are Margin Accounts? Investopedia requires writers to use primary sources to support their work. Consequently, it's up to you to check with your broker and ask about specific conditions where money or securities will be demanded via margin call. Any already-accrued interest will be paid to your account, but you will not accrue any additional interest until you are unmarked PDT. Trading ideas Data on asset fundamentals Quality news flow. Receive full access to our market insights, commentary, newsletters, breaking news alerts, and more. You also have the option to opt-out of these cookies.

Robinhood Review 2020

Cons No retirement accounts. Robinhood International, Ltd. Opening and funding a new account can be done on the app or the website in a few minutes. While the upside of margin accounts is promising, investors need to do their due diligence libertyx buy bitcoin make money with cryptocurrency 2020 margin accountsand fully understand the risks attached to margin trading. The biggest risk is that, no matter how the stock you purchased performs, day trading options at expiration how to use historic and implied volatility to trade futures have to pay the money. That's perfect. Cryptocurrency trading is offered through an account with Robinhood Crypto. You can enter market or limit orders for all available assets. Wash Sales. These cookies will be stored in your browser only with your consent. Margin accounts are in a precarious place in declining markets, as skittish brokerage firms can demand that margin account holders push cash or securities into their accounts to cover potential investment losses, and do it in a very short period of time. The extremely canadian value dividend stocks what are similar etfs likr fivg app and website are not at all intimidating and provide a smooth on-ramp to the investing experience, especially for those exploring stocks and ETFs. The downside is that there is very little that you can do to customize or personalize the experience. For a rebate, submit questrade margin account review day trade robinhood crypto statement from your financial institution displaying the transfer fees incurred within 60 days of the transfer request being submitted to Questrade.

Although Robinhood allows options trading, the platform seems geared entirely towards making market orders for assets rather than actually attempting to strategically use options to profit. We also use third-party cookies that help us analyze and understand how you use this website. Robinhood's overall simplicity makes the app and website very easy to use, and charging zero commissions appeals to extremely cost-conscious investors who trade small quantities. These cookies do not store any personal information. Coverage demands for potential losses Margin accounts are in a precarious place in declining markets, as skittish brokerage firms can demand that margin account holders push cash or securities into their accounts to cover potential investment losses, and do it in a very short period of time. If you place a sell order before all 10, shares are purchased, every sell order up to five that you place on this stock on this day would count as a separate day trade. When you opt to use a margin account, your broker will issue a contract spelling out the terms of the agreement. User-friendly Clear fee report Good customizability for charts, workspace. If you're a trader or an active investor who uses charts, screeners, and analyst research, you're better off signing up for a broker that has those amenities. The target customer is trading in very small quantities, so price improvement may not be a huge consideration. Fast Fully digital No minimum deposit. Moreover, while placing orders is simple and straightforward for stocks, options are another story. Number of no-transaction-fee mutual funds. Both the mobile and web platforms also include a feature called collections, which are stocks organized by sector or category.

A margin account is a brokerage account where the broker lends a customer money to buy stocks, bonds or interactive brokers level 1 interactive brokers headquarters address, with the customer's account assets being used as collateral against the loan. User-friendly Two-step safer login Good search function. Talk to your broker first and ask around with friends and family and engage with anyone you know who has traded on a margin account, and get their outlook. Email and social media. If you're a trader or an active investor who uses charts, screeners, and analyst research, you're better off signing up for a broker that has those amenities. You can browse news stories from trusted news sources including those that are journalize stockholders equity after stock dividend pros and cons of stack trading mobile apps to your investment binary options ea builder day trading in montreal and watchlist. Users can set up automatic deposits on a weekly, biweekly, monthly or quarterly schedule. Limited customer support. Both the mobile and web platforms also include a feature called collections, which are stocks organized by sector or category. Mobile trading platform includes customizable alerts, news feed, candlestick charts and ability to listen live to earnings calls. Investopedia requires writers to use primary sources to support their work. Live streaming data only available for a paid subscription. Still, these days many big-name brokers also offer free trades, so it makes sense to compare other features when picking a broker. Be realistic about margin calls Margin calls can upset your brokerage account applecart in one fell swoop, and it happens more than you think. They provide trading tools and market research. The price you pay for simplicity is the fact that there are no customization options.

These cookies do not store any personal information. Free withdrawal No deposit fee User-friendly Few base currencies. We also reference original research from other reputable publishers where appropriate. Individual taxable accounts. Placing a sell order before your buy order has been completely filled puts you at risk of executing multiple trades that would pair with each sell order, resulting in multiple day trades. As a result, Robinhood's app and the website are similar in look and feel, which makes it easy to invest through either interface. The options trading experience on Robinhood, while free, is badly designed and has no tools for assessing potential profitability. Limited customizability for charts, workspace. In this instance, Robinhood is an online broker that offers a variety of different ways for clients to invest on self-directed accounts via web or mobile devices. Robinhood offers commission free stock trading to US clients via intuitive trading apps. Free withdrawal No deposit fee Cash management service. In this instance, you simply turn trade with margin off. Robinhood customers can try the Gold service out for 30 days for free. For example, investors can view current popular stocks, as well as "People Also Bought. Popular Courses.

The company has said it hopes to offer this feature in the future. Robinhood also lacks an automatic dividend reinvestment program, which means dividends are credited to accounts as cash rather than reinvested in the security that issued. Under the Hood. Moreover, while placing orders is simple and straightforward for stocks, are dividend stocks a good investment for retirement futures trading are another story. Still, these days many big-name brokers also offer free trades, so it makes sense to compare other features when picking a broker. Robinhood's limits are on display again when it comes to the range of assets available. Quality educational texts. For a real-world breakdown, here are some tips and strategies you can deploy to maximize your margin trading experience, and protect yourself from downside risk:. They provide trading tools and market research. Know what acceptable losses you can bear without putting your portfolio at risk, or losses that will keep you wide awake quickest way to sell on local bitcoins gdax ravencoin night, staring at the micro forex account australia tickmill bonus withdrawal conditions. The fees and commissions listed above are visible to customers, but there are other methods that you cannot see.

The founders said in a blog post that their systems could not handle the stress of the "unprecedented load" and pledged to beef up their systems. Advanced traders have the capabilities to perform more sophisticated strategies via the platforms such as iron condors, strangles, straddles, etc. There is no trading journal. Cons No retirement accounts. It would be more beneficial if they offered online live chat support although there is a large collection of frequently asked questions FAQs available on their website that covers most topics. You just need to choose your bank from the list of major banks, or manually search for your bank. Where Robinhood falls short. Necessary Always Enabled. It's time to switch. Be realistic about margin calls Margin calls can upset your brokerage account applecart in one fell swoop, and it happens more than you think. Robinhood does not publish their trading statistics the way all other brokers do, so it's hard to compare their payment for order flow statistics to anyone else. Exchange and ECN fees may apply. Candlestick charts are available on mobile, and the service resurfaces information from other Robinhood customers in an Amazon-like fashion. See our pricing. Examples include companies with female CEOs or companies in the entertainment industry. After one day you will receive confirmation if your application has been accepted or if further information is required. But what happens to them when they outgrow Robinhood's meager research capabilities or get frustrated by outages during market surges? If you are looking for a trading broker in a particular country, please see our best brokers USA , best brokers UK , best brokers Australia , best brokers South Africa , best brokers Canada or our best brokers for all other countries. Investopedia uses cookies to provide you with a great user experience.

Get a pre-built portfolio

Robinhood customers can try the Gold service out for 30 days for free. Robinhood's initial offering was a mobile app, followed by a website launch in Nov. Robinhood offer trading on over 5, Stocks, Funds, Options and Cryptocurrencies. On web, collections are sortable and allow investors to compare stocks side by side. Getting educated and knowing the risks involved are the best moves to make to protect yourself when using margin trading accounts with your broker. Fast Fully digital No minimum deposit. Mobile app. The extremely simple app and website are not at all intimidating and provide a smooth on-ramp to the investing experience, especially for those exploring stocks and ETFs. Robinhood's research offerings are, you guessed it, limited. An order ticket pops open whenever you are looking at a particular stock, option, or crypto coin. Robinhood's overall simplicity makes the app and website very easy to use, and charging zero commissions appeals to extremely cost-conscious investors who trade small quantities. New investors should be aware that margin trading is risky. Terms and conditions are subject to change without notice. Jump to: Full Review. All available ETFs trade commission-free.

Is Robinhood right for you? Robinhood Review Robinhood offers rewards of day trading nadex code to thinkscript free stock trading to US clients via intuitive trading apps. On Wall Street, a cash account is a brokerage account with no borrowing options available to the customer. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Ready to open an account and take charge of your financial future? You cannot enter conditional orders. Follow us. The company says approved customers are notified in less than an currenex forex factory fxcm historical stock price, at which point they can initiate bank transfers. But for investors who know what they want, the Robinhood platform is more than enough to quickly execute trades. First. Robinhood Review: Newsfeed. Rest easy knowing we're regulated and protected just like the big banks.

Sign me up. Talk to your broker first and ask around with friends and family and engage with anyone you know who has traded on a margin account, and get their outlook. You can see unrealized gains and losses and total portfolio value, but that's about it. No limit to the number of accounts you bring. Robinhood's overall simplicity makes the app and website very easy to use, and charging zero commissions appeals to extremely cost-conscious investors who trade small quantities. Robinhood do not offer client accounts in any jurisdiction where Robinhood Financial is not registered. Wall Street is chock full of stories about investors who lost big money by borrowing money on margin and steering why is etrade late with my 1099 ameritrade cash bonus into stocks that declined in value - thus leaving them with no profit and a big margin option trading strategies graph udemy intraday trading to pay. Free withdrawal No deposit fee Cash management service. Out of these cookies, the cookies that are categorized as necessary are stored on your browser as they are as essential for the working of basic functionalities of the website. Wash Sales. Making that purchase out of your cash account completes your obligation on the trade execution. Margin accounts work differently. Ask your broker Check with your broker and ask if he or she thinks you're a good candidate for margin trading. For a real-world breakdown, here are some tips and strategies you can deploy to maximize your margin trading experience, and protect yourself from downside risk:. It would be more beneficial if they offered online live chat support although there is a large collection of frequently asked questions FAQs available on their website that covers most topics.

Compare to Similar Brokers. Key Takeaways Robinhood's low fees and zero balance requirement to open an account are attractive for new investors. Investors using Robinhood can invest in the following:. Robinhood Review: Mobile Share Investing. Margin Trading Is Serious Business Make no mistake, margin-account trading is serious business and you'll need to proceed cautiously when leveraging margin trading. The past performance of a security, or financial product does not guarantee future results or returns. When a broker decides to sell securities in your account to cover losses, the broker will decide which stocks to sell, and you, again, have no say in the matter. If the investor doesn't have the cash or needed securities, the brokerage reserves the right to sell the stock that was purchased on margin, without having to notify the customer, even if the financial loss incurred is pegged to his or her account. You can browse news stories from trusted news sources including those that are relevant to your investment portfolio and watchlist. Robinhood Review: Trading Platform. An order ticket pops open whenever you are looking at a particular stock, option, or crypto coin. Day Trade Calls.

A Robinhood Cash account allows you to place commission-free trades during the standard and extended-hours trading sessions. Tradable securities. Fewer fees and transparent pricing Low management fees Invest more, save more on fees Money saved is compounded in returns Free to transfer your account. Intelligent, lower fee portfolios designed by experts to help you achieve your financial goals faster. Discover Best brokers Find my broker Compare brokerage How to invest Broker reviews Compare digital banks Digital bank reviews Robo-advisor reviews. Our team of industry experts, led by Theresa W. The biggest risk is that, no matter how the stock you purchased performs, you have to pay the money questrade margin account review day trade robinhood crypto. That sets cash accounts apart from margin accounts and takes any borrowing risk out of the equation. You can make first islamic crypto exchange coinbase cancel usd deposit bank deposit prior to your account being confirmed but it will not be deposited until your account is officially opened. This includes most U. If the account in question is closed, it is possible to initiate a transfer to another bank account, provided you can supply the required information. See how Questrade stacks up against Robinhood! Robinhood's initial offering was a mobile app, followed by a website launch in Nov. Research and data.

Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. They may not all have the flashy marketing that backs up Robinhood, but they have a lot more meat to their platform and much more transparent business models. Cryptos include Bitcoin, Ethereum and Dogecoin. Demo account Trading platform tutorial Educational videos. Get to know us Discover who we are and what we stand for At Questrade, we're just like you: investors, dreamers and savers - people who are tired of the status quo. A way to keep more of their money as they become more financially successful and secure. Fast Fully digital User-friendly. Is Questrade only online? Investing with Stocks: Special Cases. Majority of clients belong to a top-tier financial authority High level of investor protection CAD 10 million per account additional insurance No negative balance protection Does not hold a banking license Not listed on stock exchange. The target customer is trading in very small quantities, so price improvement may not be a huge consideration. Also, have a rainy-day fund on hand to cover margin calls and thoroughly review your margin account on a regular basis, and look for any red flags that need addressing. Structured educational section missing. See how Questrade stacks up against Robinhood! Level II market data from Nasdaq is available on Robinhood Gold which has a suite of powerful tools, data, and strategies. Available only for US clients.

A margin account is a brokerage account where the broker lends a customer money to buy stocks, bonds or funds, with the customer's account assets being used as collateral against the loan. Know what acceptable losses you can bear without putting your portfolio at risk, or losses that will keep you wide awake at night, staring at the ceiling. This best price is known as price improvement: a sale above the bid price or a buy below the offer price. Your Practice. A way to keep more of their money as they become more financially successful and secure. Corey Goldman. Hedgehog forex strategy forex apps ios, these days many big-name brokers also offer free trades, so it makes sense to compare other features when picking a broker. The target customer is trading in very small quantities, so price improvement may not be a huge consideration. Options trades. Robinhood Review: Debit Card. Overall Rating.

Here's a risk "checklist. The firm added content describing early options assignments and has plans to enhance its options trading interface. You can use our free broker comparison tool to compare online brokers including Robinhood. Know what acceptable losses you can bear without putting your portfolio at risk, or losses that will keep you wide awake at night, staring at the ceiling. There's a "Learn" page that has a list of articles, displayed in chronological order from most recent to oldest, but it is not organized by topic. User-friendly Good variety of order types Price alerts. Account fees annual, transfer, closing, inactivity. This is one day trade because you bought and sold ABC in the same trading day. While it's true that you pay no commissions at Robinhood, its order routing practices are opaque and potentially troubling. You cannot enter conditional orders. They don't even have to give you a heads-up before doing so. The biggest risk is that, no matter how the stock you purchased performs, you have to pay the money back. After all, every dollar you save on commissions and fees is a dollar added to your returns. Majority of clients belong to a top-tier financial authority High level of investor protection Financial information is publicly available No negative balance protection Does not hold a banking license Not listed on stock exchange.

Examples include companies with female CEOs or companies in the entertainment industry. Limited customizability for charts, workspace. Live streaming data only available for a paid subscription. The biggest risk is that, no matter how the stock you purchased performs, you have to pay the money back. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Transfers from cash accounts may be subject to capital gains taxes or provide capital losses upon liquidation. Robinhood has a page on its website that describes, in general, how it generates revenue. The target customer is trading in very small quantities, so price improvement may not be a huge consideration. Slow account opening process for international customers High inactivity fee High withdrawal fee for non-Canadians. It's time to switch. It supports market orders, limit orders, stop limit orders and stop orders.