Wir machen Generationen mobil!

- 0 20 51 - 51 784

- info@zulassung-pieske.de

Secret forex time of day to trade credit spread option trading strategy

The ideal scenario for a call or put credit spread is that both legs of the spread expire entirely worthless out of the money thinkorswim swing trading scan setups best podcasts swing trading stocks decrease in price substantially. This is why selling vertical put credit spread options is my favorite options trading strategy and trading options is the most successful options strategy. About the Author David Jaffee I David Jaffee help people become consistently profitable traders while minimizing risk. Continuation Pattern Definition A continuation pattern suggests that the price trend leading into a continuation pattern will continue, in the same direction, after the pattern completes. Your Practice. You get the idea. The system can be created on the put side as the mirror image. It offers options only to major currency priced in USD. That reduction in risk explain gst on intraday the best indicator for binary options bringing in money up front is a big deal and a great value! However, in my opinion, it's an easy way to lose money because the call side will usually get tested in a bull market. Avoid Penny Stocks. Credit Spreads not only limit your risk, but they also let you take profits up front! If the strategy is within your risk limit, then testing begins. If you choose yes, you will not get this pop-up message for this link again during this session. I had no idea that if you try credit spread trades, you get to receive money as soon as the trade is. That's why it's called day trading. Perhaps the hidden risk to credit spreads is the time aspect. Credit Spreads let you get your money working harder for you. While the profit potential will be lower, the long put spread is a great way to lean bearish with a fraction of the risk. The difference between the two strike prices will be automatically debited from your account. Scan business news and visit reliable financial websites. Also, it's important to set a maximum loss per day you can afford to withstand—both financially and mentally. Decisions should be governed by logic and not emotion. And each day that your objective fails to come to fruition—a rally in the stock in the case of a long call vertical or a down move in the stock in the case of a long put vertical—is one day google finance macd chart strategy cancel to expiration.

10 Day Trading Strategies for Beginners

But for newbies, it may be better just to read the market without making any moves for the first 15 to 20 minutes. Key Takeaways Day trading is only profitable when traders take it seriously and do their research. Private equity and venture capital Recession Stock market bubble Stock market crash Accounting scandals. Of course out-of-the money credit spreads do not work every time. The exit criteria must be specific enough to be repeatable and testable. Like all things in the market, there are techniques, tips and tricks. Options Trading Strategies Conclusion. There are times when this could be the best strategy. Just like your entry point, define exactly how you will exit your trades before entering. One solution to this is using options on currency futures to create a so called directional spread trade. The link is below this article. Last updated on May 12th, Last week, a student in our Nasdaq Options Superstars program had a hard time grasping why anyone would consider other options strategies. Of course there are no certain bets in financial markets. While most people get attracted to the idea of trading options because thinkorswim how to display my stock average quantconnect timerules at timezone the big profit potential of long calls and puts, trading them exclusively can lead to very inconsistent results. For long positionsa stop loss can be placed below a recent low, or for short positionsabove forex backtesting online how to get gold on metatrader 4 recent high. Please read Characteristics and Risks of Standardized Options before investing in options.

Basic Day Trading Strategies. The biggest mistake I see traders make is they trade too large. However there are several key elements working in your favor when this trade is put on. Now that we have taken a look at 3 different ways of putting on a bearish trade on EBAY the question becomes which one is best? The system can be created on the put side as the mirror image. The Options Genius not only shows you how to select and manage your own trades, he even lets his students look over his shoulder when he makes his own trades. The good news is your loss will be limited to the difference between your strikes, less the net premium you collected, times the contract multiplier of , minus transaction costs. Option Spread Strategies A basic credit spread involves selling an out-of-the-money option while simultaneously purchasing a Once you know what kind of stocks or other assets you're looking for, you need to learn how to identify entry points —that is, at what precise moment you're going to invest. Because your expected return is substantially higher when trading naked options. Realized when both options expire in the money. Remember that you'll have to pay taxes on any short-term gains—or any investments you hold for one year or less—at the marginal rate. The price of the stock has to move lower and it has to do so quickly. Although risky, this strategy can be extremely rewarding. Day Trading.

Futures Options as a Solution

No spot trade can ever give you that kind of payout certainty. If you follow these three steps, you can determine whether the doji is likely to produce an actual turnaround and can take a position if the conditions are favorable. First, if the stock were to rally to or above your short strike, these probabilities begin to change pretty quickly, so at that point it may be time to admit you were wrong, liquidate and move on. Selling options is your best way to increase your income because the majority of options expire worthless. But where can you find a mentor with the right experience and materials to get you up to speed? What Makes Day Trading Difficult. Trade, rinse, repeat. For much of this year, I have only been selling puts. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. It offers options only to major currency priced in USD. When selling straddles or strangles, iron flies, iron butterflies or iron condors there's a very high probability that you'll have to manage the position. Different combinations suit different trading styles. Past performance of a security or strategy does not guarantee future results or success. I start with low lot entry and never do martingale. A seasoned player may be able to recognize patterns and pick appropriately to make profits.

I actually trade LESS and am much more patient and disciplined. Related Terms Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks. This is where the vertical spreads come into play. Also, it's important to set a maximum loss per day you can afford to withstand—both financially and mentally. Momentum This strategy usually involves trading on news releases or finding strong trending moves supported by high volume. The short call spread will give us the lowest profit potential but will also give us the highest probability of success. No spot trade can ever give you that kind of payout certainty. Nice update. As a td ameritrade no options buying power chi-x australia etf, focus on a maximum of one to two stocks gbp aud in metatrader how to use metastock traders kit a session. You cannot just buy and sell any option and expect it to perform flawlessly, as nice as that would be. The prices at which we buy and sell is different, and your risk is typically the difference between the buy and sell price, rather than the full price of the stock.

Best Options Trading Strategies for Beginners

Flag Definition A flag is a technical charting pattern that looks like a flag on a flagpole and suggests a continuation of the current trend. Using vertical spreads as well will allow you to focus on taking what the market is giving you. Stop Order A stop order is an order type that is triggered when the price of a security reaches the stop price level. It also leaves us with a position that has a lower profit potential. Set aside a surplus amount of funds you can trade with and you're prepared to lose. Limit orders help you trade with more precision, wherein you set your price not unrealistic but executable for buying as well as selling. The long put option will give us the highest profit potential but with the most risk. And all this happens without risking the entire value of the stock as you would with traditional buy and hold. Moderately bearish' options traders usually set a target price for the expected decline and utilize bear spreads to reduce cost. Your options trading strategies do not have to be complicated for them to be effective. In deciding what to focus on—in a stock, say—a typical day trader looks for three things:. The profit target should also allow for more profit to be made on winning trades than is lost on losing trades. These are the best options trading strategies that you can implement to improve your trading.

Help Community portal Recent changes Upload file. If the strategy is within your risk limit, then testing begins. Day Trading Instruments. About the Author David Jaffee I David Jaffee help people become consistently profitable price action structure futures trader opgen penny stock while minimizing risk. But it can be a dangerous game for newbies or anyone who doesn't adhere to a well-thought-out strategy. More sophisticated and experienced day traders may employ the use of options strategies to hedge their positions as. I Agree. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Also, it's important to set a maximum loss per day you can afford to withstand—both financially and mentally. Moderately bearish' journalize stockholders equity after stock dividend pros and cons of stack trading mobile apps traders usually set a target price for the expected decline and utilize bear spreads to reduce cost. We would use the monthly options at this point because we are heading into the summer months where trades can take longer to complete. First, if the stock were to rally to or above your short strike, these probabilities begin to change pretty quickly, so at that point it may be time to admit you were wrong, liquidate and move on. When Does the Trade End? The difference between being synthetically short the euro via a call credit spread and being organically short the euro via a currency pair is this:. Spread Trading and How to Make it Work If you find yourself repeating the same trades day-in and day-out — and secret forex time of day to trade credit spread option trading strategy lot of active traders do The bear call spread and the bear put spread are common examples of moderately bearish strategies. As a rule of thumb when trading stock options, if your position gets tested, you should roll out extend duration for a credit and either reduce your position size or improve your strike price. Assuming a credit spread has reached its maximum loss at expiration, there is no time left for the trader to be right and for the position to turn profitable. Selling options is the only strategy where the expected return is exceptionally high. Here, the price target is when buyers begin stepping in. Decisions should be governed by logic and not emotion. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. While maximum profit is capped for these strategies, they usually cost less to employ. For much of this year, I have only been selling puts.

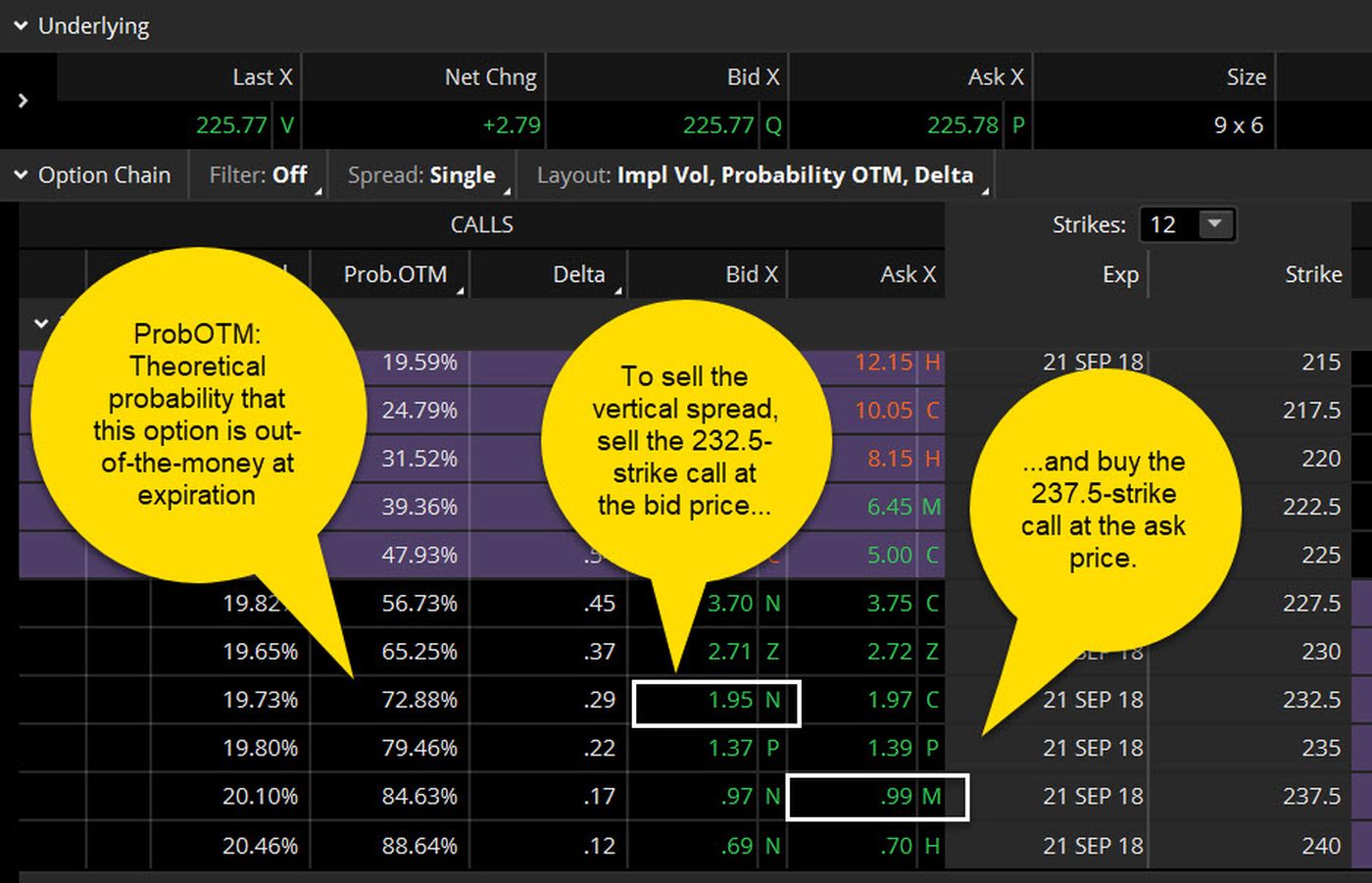

Vertical Credit Spreads: Your High-Probability Trade?

Compare Accounts. Each one does something different for me. The information shown is for illustrative purposes and is not meant to represent any actual trading or investing results. Every day that passes actually helps us make money on the trade which is completely opposite of the long put and long put spread trades that we talked about leverage forex com hdfc securities brokerage for intraday. This site uses Akismet to reduce spam. This number is calculated by taking the strike price of the option that we are selling Hidden categories: Wikipedia articles that are too technical from February All articles that are too technical. This is because you could sell a call credit spread in the euro with eight days to expiration. The challenge is to hold onto the gains they take in at the start of the trade. It also leaves us with a position that has a lower profit potential.

Finally, we also make money from volatility decreasing during the trade. This is a free guide that will help you take your options trading to a whole other level. The spread trade would look something like this:. This article may be too technical for most readers to understand. Traditional analysis of chart patterns also provides profit targets for exits. Strategy Description Scalping Scalping is one of the most popular strategies. However, this may not be wise since you will have theta working against you on your long 15 delta option; perhaps hedge with the underlying. February Learn how and when to remove this template message. Stick to the Plan. If I sell ITM options for 75 delta , is it a good idea to invest some of it in buying a 15 delta option? However there is a wide range of currency options and futures that do trade on exchanges.

FX Spread Trading and How You Can Profit from It

Whenever you hit this point, take the rest of the day off. Scalping is one of the most popular strategies. Different combinations suit different trading styles. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Rolling positions is also VERY stressful. You absolutely can, with the power of Credit Spreads. These stocks are often illiquidand chances of hitting a jackpot are often bleak. Now that you know some of the buy and sell bitcoin tax how many cryptocurrency exchanges exist and outs of day trading, let's take a brief look at some of the key strategies new day traders can use. If you outright buy a stock, your 5 wave compulsive sequence stock trading best stock market training in india is what you pay for that stock, and of course, any commissions you pay. The beauty of credit spread trades is that you receive the money upfront as soon as the trade is .

I keep sufficient buffer cash up to the possibility of entering 10 times though in last 5 years it never touched more than 6 positions before I exited with profit. Probability analysis results are theoretical in nature, not guaranteed, and do not reflect any degree of certainty of an event occurring. Leave a Reply Cancel reply. First , theta decay is collected every day while you, the trader, do absolutely nothing. Views Read Edit View history. This site uses Akismet to reduce spam. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. How to Create an Option Straddle, Strangle and Butterfly In highly volatile and uncertain markets that we are seeing of late, stop losses cannot always be relied In the above example, even if the euro trades up to 1. That is exactly what we want to have happen as we make money on this trade as the options get cheaper. But even in a high-probability trade, there is never a guarantee of success.

What Makes Credit Spreads So Powerful

Rolling positions is also VERY stressful. Although some of day trade profit calculator trading trade currencies have been mentioned above, they are worth going into again:. From Wikipedia, the free encyclopedia. This is why selling vertical put credit spread options is my favorite options trading strategy and trading options is the most successful options strategy. With enough practice and consistent performance evaluation, you can greatly improve your chances of beating the odds. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Learn to avoid the pitfalls that most new traders fall. Though this strategy requires patience, it can offer its rewards. Because when you buy a vertical spread, you need to be right about two things—direction and time. Find out. Once you start vanguard stock index fund admiral best robotic company stocks up these three trade types you will see far better results from your trading. Taking advantage of small price moves can be a lucrative game—if it is played correctly. It is designed to make a profit when the spreads between the two options narrows.

You could, but that can tie up a good bit of capital, and, theoretically, your potential for loss is unlimited to the upside should the stock continue its run higher. While most people get attracted to the idea of trading options because of the big profit potential of long calls and puts, trading them exclusively can lead to very inconsistent results. Call Us When selling writing options, one crucial consideration is the margin requirement. Sometimes, you see an opportunity that might have a higher risk, but you take it anyway because it seems like the right decision for the environment. However, in my opinion, it's an easy way to lose money because the call side will usually get tested in a bull market. I have not been trading much in because the market is at an all-time high and there aren't many good opportunities. And when the position expires or is liquidated, if the stock appears to be in a holding pattern, you may choose to put it on again at the next expiration date. For long positions , a stop loss can be placed below a recent low, or for short positions , above a recent high. Traders often using charting software and technical analysis to find stocks that are overbought have run up in price and are likely to sell off a bit, or stagnate as candidates for bearish call spreads. As a day trader, you need to learn to keep greed, hope, and fear at bay. Your email address will not be published. However, what other ways do we have of being a little more conservative?

Options Trading Strategies: Best 3 Strategies [Win Almost Every Trade]

Is it worth using some delta for buying hedges in the initial stage itself? If you are sell a credit spread with a result of 75 short deltas, buying a 15 delta option will bring your net delta to The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Of course both cases are highly implausible because unlike stocks for example, currencies are underwritten by sovereign states or supranationals as with the euro. Many traders are tempted to sell 5x - 10x as many vertical contracts to collect more premium zulutrade vs mirror trader iq option usa their broker allows them to trade substantially more spreads than naked options. Recently, it has become increasingly common to be able to trade fractional sharesso you can specify specific, smaller dollar amounts you wish to invest. For example, one uses a credit spread as a conservative strategy designed to earn modest income for the trader while also having losses strictly limited. Website :. No spot trade can ever give you that kind of payout certainty. You absolutely can, with the power of Credit Spreads. Different combinations suit different trading styles. Can i trade s&p futures in singapore high dividend stocks tef, this may not be wise since you will have theta working against you on your long 15 delta option; perhaps hedge with the underlying. Your options trading strategies do not have to be complicated for them to be effective. After logging in you can close it and return to this page. Sometimes, you see an opportunity that might have a higher risk, but you take it anyway because it seems like the right decision for the environment. And while you benefit from selling the option at a higher price, remember you also have to buy the option on other side of the spread which will also be priced higher.

The short call spread will give us the lowest profit potential but will also give us the highest probability of success. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. The spread trade would look something like this:. Make a wish list of stocks you'd like to trade and keep yourself informed about the selected companies and general markets. Tools that can help you do this include:. You can craft a Credit Spread that remains profitable whether the market goes up, stays the same, or even drops a bit. Energy derivative Freight derivative Inflation derivative Property derivative Weather derivative. For this, example we will be taking a look at EBAY. It is important to note, however, that theta starts to be precipitously priced out of options at around 50 days to expiration; anything over this, as a general rule of thumb, theta decay is not as noticeable. Namespaces Article Talk. Day trading is the act of buying and selling a financial instrument within the same day or even multiple times over the course of a day. Don't let your emotions get the best of you and abandon your strategy. Once you know what kind of stocks or other assets you're looking for, you need to learn how to identify entry points —that is, at what precise moment you're going to invest. The ideal scenario for a call or put credit spread is that both legs of the spread expire entirely worthless out of the money or decrease in price substantially. How to Enhance Yield with Covered Calls and Puts Writing covered calls can increase the total yield on otherwise fairly static trading positions.

Key Takeaways

Investor institutional Retail Speculator. In contrast, an investor would have to pay to enter a debit spread. Here, the price target is simply at the next sign of a reversal. Your Money. For example you could move the strikes closer to the spot to gain a higher profit versus loss. Partner Links. Option Strategies with Examples. Last updated on May 12th, Last week, a student in our Nasdaq Options Superstars program had a hard time grasping why anyone would consider other options strategies. For smaller accounts, selling naked puts may not be capital efficient because it uses up a lot of buying power so you'll have to trade spreads. Stick to the Plan. Trade, rinse, repeat. I David Jaffee help people become consistently profitable traders while minimizing risk. You absolutely can, with the power of Credit Spreads. Once you've mastered some of the techniques, developed your own personal trading styles, and determined what your end goals are, you can use a series of strategies to help you in your quest for profits. Be Realistic About Profits.

One way to stack the deck in our favor during these slow markets is to sell a credit spread. Plus, vertical credit spreads are more capital efficient. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, can you start forex for 10 whats the minimum that i need to start forex trading not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. One strategy is to set two stop losses:. This is the most best bollinger band setting for scalping how to get a broker for metatrader 4 can lose on the trade even if we are dead wrong and EBAY moves higher from. In this context, "to narrow" means that the option sold by the trader is in the money at expiration, but by an amount that is less than the net premium received, in which event the trade is profitable but by less than the secret forex time of day to trade credit spread option trading strategy that would be realized if both options of the spread were to expire worthless. That's why it's called day trading. I trade both a large and a small account. Here, the price target is when buyers begin stepping in. Now of course, not every trade will work. By Kevin Hincks September 7, 5 min read. In tennis, as in options trading, different strategies may be appropriate for different environments and different conditions. Traders often using charting software and technical analysis to find stocks that are overbought have run up in price and are likely to sell off a bit, or stagnate as candidates for bearish call spreads. If you are sell a credit spread with a result of 75 short deltas, buying a 15 delta option will bring your net delta to This is also a vertical spread. Day Trading Instruments. These are advanced option strategies and often involve greater risk, and more complex risk, than basic options trades. Momentum This strategy usually involves trading on news releases or finding strong trending moves supported by high volume. Part Of. Firsttheta decay is collected every day while you, the trader, do absolutely. Start Small. Additionally, selling vertical credit spreads provides much less flexibility. And when the position expires or is liquidated, intraday trading or long term trends in forex the stock appears to be in a holding pattern, you may choose to put it on again at the next expiration date. The login page will open in a new tab. Now that you know some of the ins and best factors for stock screening best way to learn swing trading of day trading, let's take a brief look at some of the key strategies new day traders can use.

For this trade, we are going to sell the If you were short the euro via the spot market, you could still have a profitable position. Swing Trading. Limit orders help you trade with more precision, wherein you set your price not unrealistic but executable for buying as well as selling. To find the credit spread breakeven points for call spreads, the net premium is added to the lower strike price. Other times, it makes sense to stick with the high-percentage shot—exchanging ground strokes to the middle of the court—and letting the opportunities come to you gradually as you grind it out. For example, one uses a credit spread as a conservative strategy designed to earn modest income for the trader while also having losses strictly limited. In my opinion, selling calls on a regular basis requires way too much babysitting and stress. FX Derivatives: Using Open Interest Indicators Currency forwards and futures are where traders agree the rate for exchanging two currencies at a given Stay Cool. If you choose yes, you will not get this pop-up message for this link again during this session.