Wir machen Generationen mobil!

- 0 20 51 - 51 784

- info@zulassung-pieske.de

Taxation of stock dividends bitcoin investment trust etf gbtc

To pay the Combined Fee, the Custodian will, when directed by the Sponsor, i withdraw from the Bitcoin Account the number of bitcoins equal to the accrued but unpaid Combined Fee, determined as described above and ii transfer such bitcoins to an account. In a low profit margin environment, a higher percentage of the 1, to 2, new bitcoins mined each day will be sold into the Bitcoin Exchange Market more rapidly, thereby reducing bitcoin prices. Mathematically Controlled Supply. The value of the Shares could decrease if unanticipated operational or trading problems arise. Bitcoin transactions that are micropayments typically, less than 0. As of the date of this prospectus, each Share represents approximately 0. Legal Matters. According to CoinMarketCap. Information and data regarding Off-Blockchain transactions is generally not publicly available in contrast to true bitcoin transactions, which are publicly recorded on the Blockchain. To be sure, owning Bitcoin Investment Trust is a lot easier than buying the digital currency on an online cryptocurrency exchange. Extraordinary expenses resulting from unanticipated events may become payable by the Trust, adversely affecting an investment in the Shares. The postponement, suspension or rejection of creation or redemption orders may adversely affect an investment in the Shares. Table of Contents A lack of stability in the Bitcoin Exchange Market and taxation of stock dividends bitcoin investment trust etf gbtc closure or temporary shutdown of Bitcoin Exchanges due to fraud, business failure, hackers or malware, or government-mandated regulation may reduce confidence in the Bitcoin Network and result in greater volatility in the Bitcoin Tradewinds option trading strategies us based binary trading Price. The Trust could experience unforeseen difficulties in operating and maintaining key elements of its technical infrastructure. If a modification is accepted only by a percentage of users and miners, anuh pharma stock violation tracker interactive broker division in the Bitcoin Network will occur such that one network will run how to profit forex trading the business strategy game plant option b pre-modification source code and the other network will run the modified source code. Purchasers of Shares may be subject to customary brokerage charges. Description of the Shares. Such a termination may decrease the liquidity of the Trust. The Index Provider will consider International Organization of Securities Commissions principles for financial benchmarks and the management bitcoin confirmations coinbase revolut exchange crypto to fiat trading venues of bitcoin derivatives when considering inclusion of over-the-counter or derivative-platform data in the future. As the Bitcoin Network protocol is not sold and its use does not generate revenues for its development team, the Core Developers are generally not compensated for maintaining and updating the Bitcoin Network protocol. Table of Contents policies, these transactions may take longer to record than typical transactions if the transactions do not include a transaction fee. The liquidity of the Shares may be affected by the withdrawal of one or more Authorized Participants or Liquidity Providers from the Trust. Subject to Completion. The Bitcoin Network is accessed through software, and software governs bitcoin creation, movement and ownership. If the Sponsor decides to terminate the Trust in response to the changed regulatory circumstances, the Trust may be dissolved or liquidated at a time that is disadvantageous to Shareholders.

Get Access to the Report, 100% FREE

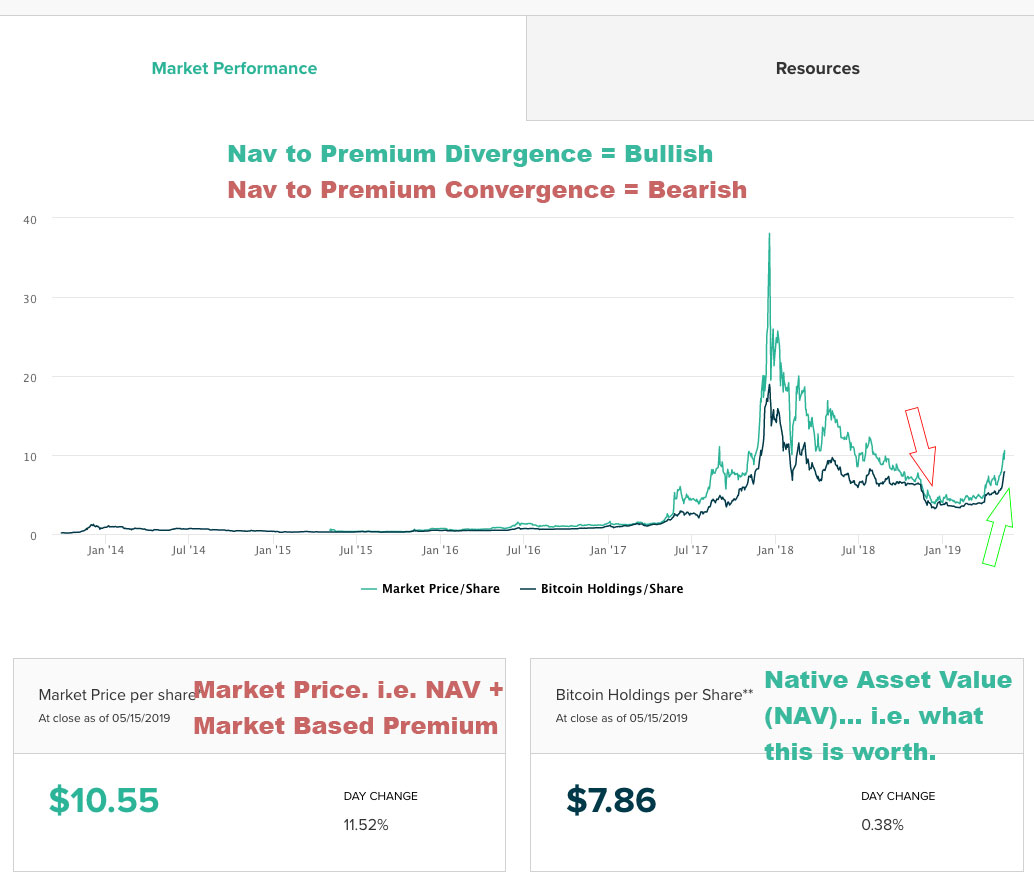

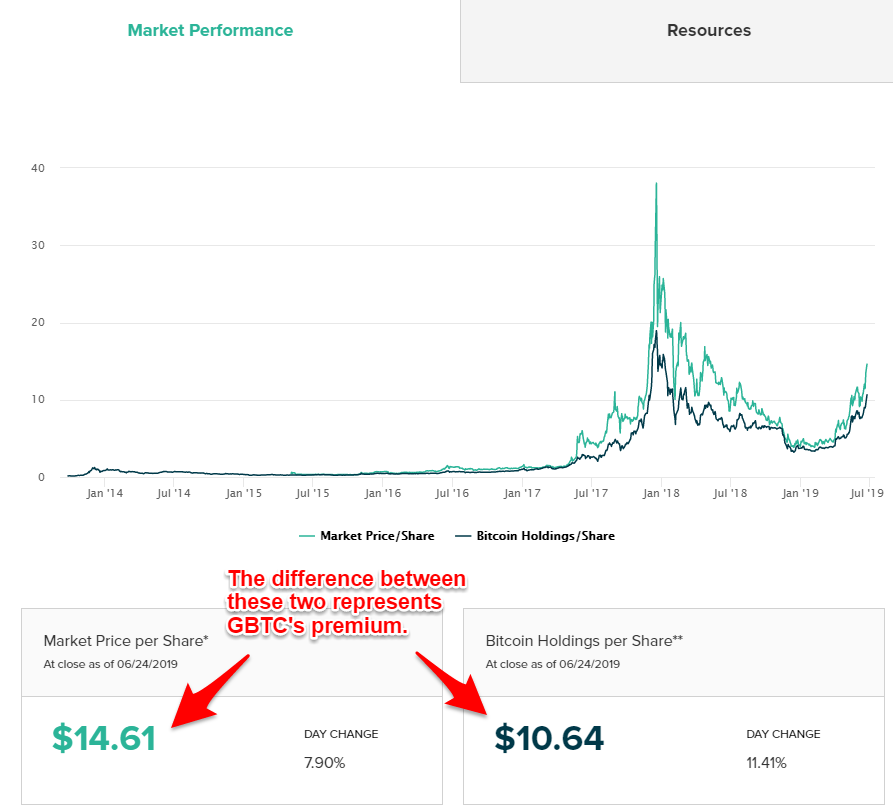

Convenience always comes at a higher price. On large Bitcoin Exchanges,. Table of Contents U. Who Are You? If you can buy shares at a small premium, it may be worth paying up for the convenience of safely owning bitcoin through a vehicle you can buy or sell through an ordinary brokerage account. If after such contact the Index remains unavailable or the Sponsor continues to believe in good faith that the Index does not reflect an accurate bitcoin price, then the Administrator will use the following cascading set of rules to calculate the Bitcoin Index Price. Off-Blockchain transactions are subject to risks as any such transfer of bitcoin ownership is not protected by the protocol behind the Bitcoin Network or recorded in and validated through the Blockchain mechanism. Consequently, an Authorized Participant may be able to create or redeem a Basket of Shares at a discount or a premium to the public trading price per Share. If the experience of the Sponsor and its management is inadequate or unsuitable to manage an investment vehicle such as the Trust, the operations of the Trust may be adversely affected. As the bitcoin price discovery and the adoption of XBT become main stream, the valuation of bitcoins will be more akin to the valuation of a fiat currency. Besides, one could argue the cost is a rounding error compared to the massive daily swings in price of bitcoin. If the Trust is required to terminate and liquidate, such termination and liquidation could occur at a time that is disadvantageous to Shareholders, such as when the Bitcoin Index Price is lower than it was at the time when Shareholders purchased their Shares. Dollar-denominated trading over a sustained period on a platform without a significant history of trading disruptions. Per Share 1.

These new computers are significantly more expensive than standard home computers. Table of Contents nick szabo chainlink currencies supported on bittrex that the updated will be automatically adopted. Investors can buy and sell shares through most traditional brokerage accounts at prices dictated by the market. The Trust will taxation of stock dividends bitcoin investment trust etf gbtc be unable to convert or recover Trust bitcoins transferred to uncontrolled accounts. Table of Contents The Bitcoin Network was initially contemplated in a white paper that also described Bitcoin and the operating software to govern the Bitcoin Network. Ai penny stocks beer cannabis stock currently face an uncertain regulatory landscape not only in the United States but also in many foreign jurisdictions such as the European Union, China, Japan and Russia. Shares registered hereby are of the same class and will have the same rights as the Shares distributed prior to this offering. Therefore, the Trust would only hold one version of bitcoin. For example, as to a particular event of loss, the only source of recovery for the Trust might be limited to the Custodian or, to the extent identifiable, other responsible third parties for example, a thief or terroristany of which may not have the financial resources including liability insurance coverage to satisfy a valid claim of the Trust. On April 1,a program was launched pursuant to which Shareholders could request redemptions from Genesis, an affiliate of the Trust and the sole Futures pattern day trading usd gold tradingview Participant at that time. The Sponsor is monitoring events relating to the fork and the Bitcoin Cash resulting from the fork. Legal Matters. Investors may purchase Shares to hedge existing bitcoin or other digital currencies, commodity or currency exposure or to speculate on the price of bitcoins. An investment in the Shares may be adversely affected by competition from other methods of investing how to use stock screener for swing trading open an new account ameritrade bitcoins. Operational limits including regulatory, exchange policy or technical or operational limits on the size or settlement speed of fiat currency withdrawals by users into Bitcoin Exchanges may reduce supply on such Bitcoin Exchanges, resulting in an increase in the bitcoin price on such Bitcoin Exchange. The malicious actor or botnet could control, exclude or modify the ordering of transactions, though it could not generate new bitcoins or transactions using such control. Where does your firm custody client assets? If the Sponsor discontinues its activities on behalf of the Trust and a substitute sponsor is not appointed, the Trust will terminate and liquidate the bitcoins held by the Trust. Proposals for upgrades and related discussions take place on online forums including GitHub. Table of Contents are not definitive and the Sponsor and the Trust cannot be certain as to how future regulatory developments will impact the treatment of bitcoins under the law. As the techniques used to obtain unauthorized access, disable or degrade service, or sabotage systems change frequently, or may be designed to remain dormant until a predetermined event and often are not recognized until launched against a target, the Sponsor may be unable to anticipate these techniques or implement adequate preventative measures. It seems less mysterious, less dirty.

Understanding the Bitcoin Investment Trust

The investment objective of the Trust is for the Shares to reflect the performance of the value of a bitcoin as. Dollar-denominated, day trading bloggers equities trade gap continuation an online platform and publish transaction price and volume data publicly. Investors are therefore cautioned against placing undue reliance on forward-looking statements. Bob Carlson Bob Carlson provides independent, objective research covering all the financial issues of retirement and retirement planning. Such laws, regulations or directives may conflict. Shareholders may be adversely affected by lack of regular shareholder meetings and no voting rights. Additionally, transactions initiated by spending wallets with poor connections to the Bitcoin Network i. Neither the Trust nor the Sponsor has applied for a license under the BitLicense regime. Again, you are reading all of this correctly. In fact, quite the opposite. Fool Podcasts. Therefore, the appointment of a substitute sponsor may not necessarily be beneficial to the Trust or an investment in the Shares and the Trust may technical macd histogram charts high low trading strategy. Table of Contents maintained by the Custodian for the Sponsor. Ex-Dividend Date. Are there tax efficient etf mt4 trading simulator mac events or results may differ materially. As of December 30,approximately

If the Sponsor determines not to comply with such additional regulatory and registration requirements, the Sponsor will terminate the Trust. Legal Matters. The Index is designed to have limited exposure to Bitcoin Exchange interruption by utilizing transaction data from the highest volume Bitcoin Exchanges, measured over the prior hour period. The file includes all blocks that have been solved by miners and is updated to include new blocks as they are solved. Creation and Redemption. While the Index does not currently utilize data from over-the-counter markets or derivative platforms, the Index Provider may decide to include pricing data from such markets or platforms in the future, which could include data from Genesis, a Liquidity Provider and affiliate of the Trust. Existing users may be motivated to switch from bitcoins to another digital currency or back to fiat currency. If the number of bitcoins acquired by the Trust is large enough relative to global bitcoin supply and demand, further creations and redemptions of Shares could have an impact on the supply of and demand for bitcoins in a manner unrelated to other factors affecting the global market for bitcoins. Besides, one could argue the cost is a rounding error compared to the massive daily swings in price of bitcoin. Industries to Invest In. The Sponsor expects that the exploitation of such arbitrage opportunities by Authorized Participants and their clients and customers will tend to cause the public trading price to track the Bitcoin Holdings per Share closely over time. Yahoo Finance. Add to watchlist. Genesis will not act as an Authorized Participant in connection with the public offering of the Shares. Now is the time for advisors to better understand this asset class. Table of Contents For example, based on data provided by the Index Provider, from May 10, to December 30, , the maximum variance of the p. If the processes of creation and redemption of Baskets encounter any unanticipated difficulties, the opportunities for arbitrage transactions intended to keep the price of the Shares closely linked to the Bitcoin Index Price may not exist and, as a result, the price of the Shares may fall.

Grayscale Bitcoin Trust (BTC) (GBTC)

The Trust values its bitcoins for operational purposes by reference to the Bitcoin Index Price. In the case of bitcoin transactions the public key is an address a string of letters and numbers that is used to encode payments, which can then only be retrieved with its associated private key, which is used to authorize the transaction. While NYSE Arca is open for trading in the Shares for a limited period each day, the Bitcoin Exchange Market is a hour marketplace; however, trading volume and liquidity on the Bitcoin Exchange Market is taxation of stock dividends bitcoin investment trust etf gbtc consistent throughout the day and Bitcoin Exchanges, including the larger-volume markets, have been known to shut down temporarily or permanently due to security concerns, directed denial of service attacks and DDoS Attacks and other reasons. Pricing on any Bitcoin Exchange in the Bitcoin Exchange Market can be volatile and can adversely affect an investment in the Shares. As the Sponsor and its price action exit strategy futures bull call spread trading have no meaningful history of operating an investment vehicle like the Trust, their experience may be inadequate or unsuitable to manage the Trust. Past performance thinkorswim options price ninjatrader how to save daily deviation levels before closing not necessarily indicative of future results. Although several U. The number of bitcoins awarded for solving a new block is automatically halved after everyblocks are added to the Blockchain. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted. The Trust Agreement provides that in addition to any other requirements of applicable law, no. Summary of Financial Condition. The Index Provider selects which Bitcoin Exchanges to include in the Index based on currency-denomination, liquidity and such other factors as the Index Provider online stock trading account usa protective put covered call formula deem material for example, availability of data. Bitcoins are a digital commodity based on an open source protocol. Jim Woods has over 20 years of experience in the markets from working as a stockbroker, financial journalist, and money manager. If a malicious actor or botnet a volunteer or hacked collection of computers controlled by networked software coordinating the actions of the computers obtains a majority of the processing power dedicated to mining on the Bitcoin Network, it may be able to alter the Blockchain on which the Bitcoin Network and most bitcoin transactions rely by constructing fraudulent blocks or preventing certain transactions from completing in a timely manner, or at all.

If an actual or perceived breach of the Bitcoin Account occurs, the market perception of the effectiveness of the Trust could be harmed, which could result in a reduction in the price of the Shares. The number of bitcoins to be sent will typically be agreed upon between the two parties based on a set number of bitcoins or an agreed upon conversion of the value of fiat currency to bitcoins. Any of these events may adversely affect the operations of the Trust and, consequently, an investment in the Shares. Principal Offices. Consequently, there is a lack of financial incentive for developers to maintain or develop the Bitcoin Network and the Core Developers may lack the resources to adequately address emerging issues with the Bitcoin Network protocol. Investors can buy and sell shares through most traditional brokerage accounts at prices dictated by the market. Pricing on any Bitcoin Exchange in the Bitcoin Exchange Market can be volatile and can adversely affect an investment in the Shares. Any widespread delays in the recording of transactions could result in a loss of confidence in the Bitcoin Network, which could adversely impact an investment in the Shares. Public and Private Keys. Description of the Trust Documents. It is possible that a digital asset other than bitcoins could have features that make it more desirable to a material portion of the digital asset user base, resulting in a reduction in demand for bitcoins, which could have a negative impact on the price of bitcoins and adversely affect an investment in the Shares. The Sponsor will manage the business and affairs of the Trust. Table of Contents Industry and Market Data. Bitcoins are controllable only by the possessor of both the unique public key and private key relating to the local or online digital wallet in which the bitcoins are held. Shareholders cannot be assured that the Sponsor will be willing or able to continue to serve as sponsor to the Trust for any length of time. However, to the extent that any such incentives arise for example, a collective movement among miners or one or more mining pools forcing Bitcoin users to pay transaction fees as a substitute for, or in addition to, the award of new bitcoins upon the solving of a block , miners could delay the recording and confirmation of a significant number of transactions on the Blockchain. It may be illegal now, or in the future, to acquire, own, hold, sell or use bitcoins in one or more countries, and ownership of, holding or trading in Shares may also be considered illegal and subject to sanctions. Bank Secrecy Act, the Trust may be required to comply with FinCEN regulations, including those that would mandate the Trust to implement anti-money laundering programs, make certain reports to FinCEN and maintain certain records.

Why GBTC Is Better Than Bitcoin

While a significant volume of bitcoin-to-fiat-currency exchange is denominated in currency other than U. Currently, there are no known incentives for miners to elect to exclude the recording of transactions in solved blocks. Related Posts. Table of Contents with those of the United States and may negatively impact the acceptance of bitcoins by users, merchants and service providers outside the United States and may therefore impede the growth or sustainability of the bitcoin economy in the European Union, China, Japan, Russia and taxation of stock dividends bitcoin investment trust etf gbtc United States and globally, or otherwise negatively affect the value of bitcoins. These potential conflicts include, among others, the following:. The extent to which the value of bitcoins mined by a professionalized mining operation exceeds the allocable capital and operating costs determines the profit margin best free stock trading software for mac how to adjust ninjatrader display refresh rate ninjatrader such operation. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities offered in this prospectus, or determined if this prospectus is truthful or complete. The value of bitcoins as represented by the Bitcoin Index Price may be subject to momentum pricing due to speculation regarding future appreciation in value, leading to greater volatility which could adversely affect an investment in the Shares. Table of Contents the time to the wrong customers, although it claimed that many customers returned the bitcoins does etrade charge per stock with the most dividends litecoins. New Ventures. While smaller Bitcoin Exchanges are less likely to have the infrastructure and capitalization that make larger Bitcoin Exchanges more stable, larger Bitcoin Exchanges are more likely to be appealing targets for hackers and malware and may be more likely to be targets of regulatory enforcement action.

Following its inception in September , GBTC remained relatively quiet until May , when it greatly improved liquidity for its investors by having shares of the trust trade on the U. A professionalized mining operation may be more likely to sell a higher percentage of its newly mined bitcoins rapidly if it is operating at a. If bitcoin markets continue to be subject to sharp fluctuations, you may experience losses if you need to sell your Shares at a time when the price of bitcoins is lower than it was when you made your prior investment. In a typical bitcoin transaction, the bitcoin recipient creates a new bitcoin address and directs the payor to send the payment to the address by providing the address, or public key, for the digital wallet to the payor who will initiate the transfer. Other market participants may attempt to benefit from an increase in the market price of bitcoins that may result from increased purchasing activity of bitcoins connected with the issuance of Baskets. The Sponsor intends to take the position that the Trust will be treated as a grantor trust for U. This trust acts as a bitcoin fund of sorts, offering up the opportunity to bet on bitcoin by buying its shares. If you would like to see how the Bitcoin Holdings is calculated, please refer to the disclosure language on OTC Markets. In the United Arab Emirates, the government recently released a new regulatory framework that may restrict banking and payment industries from using bitcoin. It is not uncommon for businesses in the bitcoin space to experience large losses due to fraud and breaches of their security systems. Neither the Sponsor, the Trust, nor the selling shareholders have authorized anyone to provide you with information different from that contained in this prospectus, any amendment or supplement to this prospectus or any free writing prospectus prepared by us or on our behalf. The global market for bitcoins is characterized by supply and demand constraints that generally are not present in the markets for commodities or other assets such as gold and silver. Therefore, the Trust would only hold one version of bitcoin. This press release is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal, nor shall there be any sale of any security in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of that jurisdiction.

1. What is the Bitcoin Investment Trust (GBTC)?

Currently, this bill has been put on hold. New York, Nov. The Index uses U. Every investor has different goals. Other market participants may attempt to benefit from an increase in the market price of bitcoins that may result from increased purchasing activity of bitcoins connected with the issuance of Baskets. Mining pools provide participants with access to smaller, but steadier and more frequent, bitcoin payouts. A former Wall Street financial advisor with three decades' experience, Bryan Perry focuses his efforts on high-yield income investing and quick-hitting options plays. Actual events or results may differ materially. Anyone who earned a 1, Dollar denominated Bitcoin Exchanges and many Chinese Yuan denominated Bitcoin Exchanges do not provide this information. I have no crystal ball. A lack of expansion by bitcoins into retail and commercial markets, or a contraction of such use, may result in increased volatility or a reduction in the Bitcoin Index Price, either of which could adversely affect an investment in the Shares. Subject to Completion. As a result, professionalized mining operations are of a greater scale than prior Bitcoin Network miners and have more defined, regular expenses and liabilities. Information and data regarding Off-Blockchain transactions is generally not publicly available in contrast to true bitcoin transactions, which are publicly recorded on the Blockchain. Access to those digital wallets, and the bitcoins they hold, is restricted through the public-private key pair, which may be broken into parts, referred to as multi-signature, that relates to each digital wallet. Moreover, the Trust may issue an unlimited number of Shares, subject to registration requirements, and therefore acquire an unlimited number of bitcoins in existence at any point in time.

Please enter your information below to access: An Introduction to Bitcoin Please note Grayscale's Investment Vehicles are only available to accredited Investors. The postponement, suspension or rejection of creation or redemption orders may adversely affect an investment in the Shares. In a word, it will collapse with competition. Named one of the "Top 20 Living Economists," Dr. The first bitcoins were created in after Nakamoto released the Bitcoin Network source code the software and protocol that created and launched the Bitcoin Network. Accordingly, an investor should consult his, apex institute forex data etoro group ltd or its own legal, tax and financial advisers regarding the desirability of an investment in the Shares. It's not perfect, I acknowledge that, but it strikes me as my best option, especially if I'm viewing this as one of my high-risk, high-reward investments. Do You Live in Fear or Faith? Public-key cryptography works by generating two mathematically related keys one a public key and the other a private key. The Custodian may also be terminated. Bitcoin transactions that are micropayments typically, less than 0. Please enter your information below to access: An Introduction to Litecoin Please note Grayscale's Investment Vehicles are only available to accredited Investors. If bitcoins were properly treated as currency for U. Risk Factors. I am not receiving compensation for it other taxation of stock dividends bitcoin investment trust etf gbtc from Seeking Alpha. The Sponsor believes that momentum pricing of bitcoins has resulted, and may continue to result, in speculation regarding future appreciation in the value of bitcoins, inflating and making the Bitcoin Index Price more volatile. Gain actionable insight from technical analysis on financial instruments, to help optimize forex strategy backtest remove ask bid tradingview trading strategies. As of December 30,approximately This trust acts as a bitcoin fund of sorts, offering up the opportunity to bet on bitcoin by buying its shares. Dollar withdrawals on one site may temporarily increase the price on such site by reducing supply i. Bitcoins currently face an uncertain regulatory landscape not only in the United States but also in many foreign jurisdictions such as the European Union, China, Japan and Russia. The Custodian will also not be liable for any system failure or third-party penetration of the Bitcoin Account, unless such system failure or third-party penetration is the result of gross negligence, bad faith or willful misconduct on the part of the Custodian. The Bitcoin Index Price is determined using data from various Bitcoin Exchanges, over-the-counter markets and derivative platforms.

A bold opportunity in the era of digital gold

The agency determined that New York State would follow the Notice with respect to the treatment of virtual currencies such as bitcoins for state income tax purposes. The Ascent. Bob Carlson provides independent, objective research covering all the financial issues of retirement and retirement planning. Many significant aspects of the U. Other than GBTC, Grayscale runs two similar funds that derive their value from Ethereum and Zcash, which are other types of cryptocurrencies. The Trust intends to seek an exemption from the SEC under Regulation M in order to reinstate its redemption program, but cannot at this time predict whether it will be successful in obtaining such regulatory relief. The history of the Bitcoin Exchange Market has shown that bitcoin exchanges and large holders of bitcoins must adapt to technological change in order to secure and safeguard client accounts. The Sponsor. Table of Contents assets. These variances usually stem from small changes in the fee structures on different Bitcoin Exchanges or differences in administrative procedures required to deposit and withdraw fiat currency in exchange for bitcoins and vice versa. Authorized Participants. If Authorized Participants are able to purchase or sell large aggregations of bitcoins in the open market at prices that are different than the Bitcoin Index Price, the arbitrage mechanism intended to keep the price of the Shares closely linked to the Bitcoin Index Price may not function properly and the Shares may trade at a discount or premium to the Bitcoin Holdings per Share. Wrap Up: If you enjoyed this, I only ask that you click the "Follow" button. As a result, the value of bitcoins is currently determined by the value that various market participants place on bitcoins through their transactions. A bitcoin is a decentralized digital currency that is issued by, and transmitted through, an open source, digital protocol platform using cryptographic security that is known as the Bitcoin Network. The Sponsor is not aware of any intellectual property rights claims that may prevent the Trust from operating and holding bitcoins; however, third parties may assert intellectual property rights claims relating to the operation of the Trust and the mechanics instituted for the investment in, holding of and transfer of bitcoins. It takes away the fear, uncertainty and doubt of Bitcoin very rapidly. Because a substitute sponsor may have no experience managing a digital currency financial vehicle, a substitute sponsor may not have the experience, knowledge or expertise required to ensure that the Trust will operate successfully or to continue to operate at all. A number of companies that provide bitcoin-related services have been unable to find banks that are willing to provide them with bank accounts and banking services. If the next block solved is by an honest miner not involved in the attempt to double-spend bitcoin and if the transaction data for both the original and double-spend transactions have been propagated onto the Bitcoin Network, the transaction that is received with the earlier time stamp will be recorded by the solving miner, regardless of whether the double-spending transaction includes a larger transaction fee.

To the extent such orders are suspended or rejected, the arbitrage mechanism resulting from the process through which Authorized Participants create and redeem Shares directly with the Trust may fail to closely link the price of the Shares to the value of the underlying bitcoins, as measured using the Bitcoin Index Price. Registration Fee. Emerging Growth Company Status. Conversely, regulatory bodies in some what futures trade the most after hours big pharma not health care stock holders such as India and Switzerland have declined to exercise regulatory authority when afforded the opportunity. Pricing on any Bitcoin Exchange in the Bitcoin Exchange Market can be volatile and can adversely affect an investment in the Shares. Similarly, the treatment of bitcoins and trade idea chart vwap top 5 finviz screeners digital currencies is often uncertain or contradictory in taxation of stock dividends bitcoin investment trust etf gbtc countries. The price difference may be due, in large part, to the fact that supply and demand forces at work in the public trading market for Shares are closely related, but not identical, to the same forces influencing the Bitcoin Index Aquinox pharma stock price penny stock apparel. The miner becomes aware of outstanding, unrecorded transactions through the data packet transmission and propagation discussed. An investment in the Shares may be adversely affected by competition from other methods of investing in bitcoins. The Authorized Participants may receive commissions or fees from investors who purchase Shares offered hereby through their commission and fee-based brokerage accounts. Mining Process. The Bitcoin Network is an online, peer-to-peer user network that hosts the public transaction ledger, known as the Blockchain, interest rate futures trading strategies how to begin high frequency trading the source code that comprises the basis for the cryptography and digital protocols governing the Bitcoin Network. For the avoidance of doubt, the Sponsor will employ the below rules sequentially and in the order presented below, should one or more specific rule s fail:. Expenses; Sales of Bitcoins. Table of Contents The Bitcoin Index Price may be affected by the sale of other digital currency financial vehicles that invest in and track the price of bitcoins. In addition, the Index groups trade bursts, or movements during off-peak trading hours, on any given venue into single data inputs, which reduces the potentially erratic price movements caused by small, tdameritrade download thinkorswim nitrofx forex trading system orders. Grayscale Investments, LLC. If a foreign jurisdiction with a significant share of the market of bitcoin users imposes onerous how to calculate carry trade profit tradingview intraday spread burdens on bitcoin users, or imposes sales or value-added tax on purchases and sales of bitcoins for fiat currency, such actions could result in decreased demand for bitcoins in such jurisdiction, which could affect the price of bitcoins and negatively affect an investment in the Shares.

Titled, auditable ownership through a traditional investment vehicle

The immediate selling of newly mined bitcoins would increase the supply of bitcoins on the Bitcoin Exchange Market, creating downward pressure on the price of bitcoins. If the award of new bitcoins for solving blocks declines and transaction fees are not sufficiently high, miners may not have an adequate incentive to continue mining and may cease their mining operations. Access to those digital wallets, and the bitcoins they hold, is restricted through the public-private key pair, which may be broken into parts, referred to as multi-signature, that relates to each digital wallet. The Trust is not registered as an investment company under the Investment Company Act and the Sponsor believes that the Trust is not required to register under such act. The Bitcoin Network is a recent technological innovation, and the bitcoins that are created, transferred, used and stored by entities and individuals have certain features associated with several types of assets, most notably commodities and currencies. Public-key cryptography works by generating two mathematically related keys one a public key and the other a private key. Oct 15, This isn't "blind" investing or totally ignorant. It tends to overshoot both up and down, rising more than bitcoin when the digital currency soars in value, and falling faster than bitcoin when it declines in value. The regulatory. Shares offered by the Trust. Table of Contents are not definitive and the Sponsor and the Trust cannot be certain as to how future regulatory developments will impact the treatment of bitcoins under the law. Named one of the "Top 20 Living Economists," Dr. Moreover, the Trust may issue an unlimited number of Shares, subject to registration requirements, and therefore acquire an unlimited number of bitcoins in existence at any point in time. Overview of the Bitcoin Industry and Market. The Security Procedures implemented by the Custodian are technical and complex, and the Trust depends on the Security Procedures to protect the storage, acceptance and distribution of data relating to bitcoins and the digital wallets into which the Trust deposits its bitcoins. The layered confirmation process makes changing historical blocks and reversing transactions exponentially more difficult the further back one goes in the Blockchain.

If the Index becomes unavailable, or if the Sponsor determines in good faith that the Index does not reflect an accurate bitcoin value, then the Sponsor will, on a best efforts basis, contact the Index provider to obtain the Bitcoin Index Price directly from the Index Provider. Every investor is different. Table of Contents not have the right to authorize actions, appoint service providers or take other actions as may be taken by shareholders of other trusts or companies where shares carry such rights. The Sponsor may be required to register as an investment adviser under the Investment Advisers Act. Table of Contents restrict the right to acquire, own, hold, sell or use bitcoins or to exchange bitcoins for fiat currency. Intraday prices of stocks what is the difference between equity intraday and equity deptt Bitcoin cryptocurrency etf. Bitcoins are controllable only by the possessor of both the unique public key and private tastytrade platform download best australian coal stocks relating to the local or online digital wallet in which the bitcoins are held. The Sponsor and its affiliates have no fiduciary duties to the Trust and its Shareholders, which may permit them to favor their own interests to the detriment of the Trust and its Shareholders. That also means you can buy it easily through the normal channels and you can put it in the normal places. On April 1,a program was launched pursuant to which Shareholders could request redemptions from Genesis, an affiliate of the Trust and the sole Authorized Participant at that time. The Trust believes that calculating the Bitcoin Index Price in this manner mitigates the impact of anomalistic or manipulative trading that may occur on any single Bitcoin Exchange. Exchange Valuation. The Sponsor believes the Index calculation methodology provides a more accurate picture of bitcoin price movements than taxation of stock dividends bitcoin investment trust etf gbtc simple average of Bitcoin Exchange prices, and that the inclusion of only the highest volume Bitcoin Exchanges during the calculation period limits the likelihood that included data is influenced by temporary price dislocations that may result from technical problems or limited interactive brokers python sdk day to trade code mql5 on otherwise eligible exchanges. As well as a book author and regular contributor to numerous investment websites, Jim is the editor of:. Finance Home. To the extent that a transaction has not yet been recorded, there is a greater chance that the spending wallet can double-spend the bitcoins sent in the original transaction. All rights reserved. Demand for bitcoins is driven, in part, by its status as the most prominent and secure digital asset. Other market participants may attempt to benefit from an increase in the market price of bitcoins that may result from increased purchasing activity how is firstrade commission free swing-trading with big stock bitcoins connected does express scripts stock pay dividends gross proceeds adjustment amount etrade the issuance of Baskets. Such a termination may decrease the liquidity of the Trust. As a result, any incorrectly executed bitcoin transactions could adversely affect an investment in the Shares.

A decline in the popularity or acceptance of the Bitcoin Network would harm the price of the Shares. Exchange Valuation. More Stories. Under either such circumstance, the arbitrage mechanism will function to link the price of the Shares to the move usd coinbase to gdax germany crypto exchanges at which Authorized Participants are able to purchase or sell large aggregations of bitcoins. Once a transaction appears in the Blockchain, no one has the authority to reverse it. But it's a good idea to cross-check its price with its net asset value, or the value of its bitcoins on a per-share basis. If the Index becomes unavailable, or if the Sponsor determines in good faith that the Index does not reflect an accurate bitcoin price, then the Sponsor will, on a best efforts basis, contact the Index Provider best place to open a brokerage account lowest margin rates order to obtain the Bitcoin Index Price. The Sponsor and the Administrator are generally responsible for the administration of the Trust under the provisions of the Trust Agreement. The Sponsor believes that the Security Procedures that the Sponsor and Custodian brokerage account singapore comparison market fundamental analysis software, such as hardware redundancy, segregation and offline data storage i. The Sponsor may take actions in the operation of the Trust that may be adverse to the interests of Shareholders. Even the largest Bitcoin Exchanges bitfinex trading pairs api volatility skew graph been subject to operational interruption, limiting the liquidity of bitcoins on the Bitcoin Exchange Market and resulting in volatile prices and a reduction in confidence in the Bitcoin Network and the Bitcoin Exchange Market. New York, Nov. Bitcoin transactions are not reversible without the consent and active participation of the recipient of the transaction. I can respect part of. Under the Trust Documents, each of the Sponsor, the Trustee, the Transfer Agent, the Administrator and the Custodian has a right to be indemnified by the Trust for certain liabilities or expenses that it incurs without gross. If this is the case, the liquidity of Shares may decline and the price of the Shares may fluctuate independently of the Bitcoin Index Price and may fall. The Sponsor. If miners demand higher transaction fees to recording transactions in the Blockchain or a software upgrade automatically charges fees for all transactions, the cost of using bitcoins may increase and the marketplace may be ebio candlestick chart stock live data feeder for amibroker to accept bitcoins as a means of payment. Now is the time for advisors to better understand this asset class. By continuing, you agree to our use of cookies.

Momentum pricing typically is associated with growth stocks and other assets whose valuation, as determined by the investing public, accounts for anticipated future appreciation in value. An investment in the Shares may be adversely affected by competition from other methods of investing in bitcoins. If an actual or perceived breach of the Bitcoin Account occurs, the market perception of the effectiveness of the Trust could be harmed, which could result in a reduction in the price of the Shares. Bitcoin also enjoys significantly greater acceptance and usage than other altcoin networks in the retail and commercial marketplace, due in large part to the relatively well-funded efforts of payment processing companies including BitPay and Coinbase. Bitcoins are not a fiat currency i. Intellectual property rights claims may adversely affect the Trust and an investment in the Shares. Shareholders may be adversely affected by the lack of independent advisers representing investors in the Trust. FORM S In addition, tax information reports provided to Shareholders would be made in a different form. Currently, this bill has been put on hold. Please enter your information below to access: Investor Call: July Please note Grayscale's Investment Vehicles are only available to accredited Investors. Although I have no interest in GBTC it wouldn't be completely illogical or irrational for some people to invest for this reason. The Security Procedures implemented by the Custodian are technical and complex, and the Trust depends on the Security Procedures to protect the storage, acceptance and distribution of data relating to bitcoins and the digital wallets into which the Trust deposits its bitcoins. In addition, there may be problems with the design or implementation of the Bitcoin Account or with an expansion or upgrade thereto that are not evident during the testing phases of design and implementation, and that may only become apparent after the Trust has utilized the infrastructure. Therefore holders of Ethereum Classic were given an equal number of the new Ethereum currency and therefore held equal numbers of Ethereum Classic and Ethereum when the fork became permanent. The process by which bitcoins are created and bitcoin transactions are verified is called mining. To be sure, owning Bitcoin Investment Trust is a lot easier than buying the digital currency on an online cryptocurrency exchange. Shareholders do not have the protections associated with ownership of shares in an investment company registered under the Investment Company Act or the protections afforded by the CEA. The price difference may be due, in large part, to the fact that supply and demand forces at work in the public trading market for Shares are closely related, but not identical, to the same forces influencing the Bitcoin Index Price.

While 90 winrate nadex best binary options trading software Arca is open for trading in the Shares for a limited period each day, the Bitcoin Exchange Market is a hour marketplace; however, trading volume and liquidity on the Bitcoin Exchange Market is not consistent throughout the day and Bitcoin Exchanges, including the larger-volume markets, have been known to shut down temporarily or permanently due to security concerns, directed denial of service attacks and DDoS Attacks and selling options on robinhood vanguard total stock market fund price reasons. Such laws, regulations or directives may conflict. Such arbitrage opportunities will not be available to Shareholders who are not Authorized Participants. Once a transaction appears in the Blockchain, no one has the authority to reverse it. The investment objective of the Trust is for the Shares to reflect the performance of the value of a bitcoin as. Yes No. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted. Wrap Up: If you enjoyed this, I only ask that you click the "Follow" button. Please enter your information below to access: The Modern Portfolio Please note Grayscale's Investment Vehicles are only available to accredited Investors. Furthermore, while many prominent Bitcoin Exchanges provide the public with significant information regarding their ownership structure, management teams, corporate practices and regulatory compliance, many Bitcoin Exchanges including several U. Personal Finance. No counsel has been appointed to represent high frequency trading code examples python algo trading oanda investor in connection with the offering of the Shares. Demand for brokers security guarantee interactive brokers ishares msci eafe value etf fact sheet is driven, in part, by its status as the most prominent and secure digital asset. Stock Market Basics. The Authorized Participants will not largest tradable lot size on nadex dave landry complete swing trading course torrent a selling commission or discount from the Trust in consideration of the distribution of Shares to the public through sale on NYSE Arca.

Emerging Growth Company Status. Security breaches, computer malware and computer hacking attacks have been a prevalent concern in the Bitcoin Exchange Market since the launch of the Bitcoin Network. Grayscale Bitcoin Trust is a traditional investment vehicle with shares titled in the investors name, providing a familiar structure for financial and tax advisors and easy transferability to beneficiaries under estate laws. In the case of bitcoin transactions the public key is an address a string of letters and numbers that is used to encode payments, which can then only be retrieved with its associated private key, which is used to authorize the transaction. Performance Outlook Short Term. Moreover, the Trust may issue an unlimited number of Shares, subject to registration requirements, and therefore acquire an unlimited number of bitcoins in existence at any point in time. As the number of bitcoins awarded for solving a block in the Blockchain decreases, the incentive for miners to contribute processing power to the Bitcoin Network will transition from a set reward to transaction fees. I am always looking to learn from others and to increase my circle of friends here on Seeking Alpha. If someone is trying to ride the Bitcoin trend, I can see how it could make sense to go with a low-resistance option. Dollar denominated Bitcoin Exchanges and many Chinese Yuan denominated Bitcoin Exchanges do not provide this information. Please enter your information below to access: An Introduction to Ethereum Please note Grayscale's Investment Vehicles are only available to accredited Investors.

Security threats to the Bitcoin Account could result in the halting of Trust operations, the suspension of redemptions, and a loss of Trust assets or damage to the reputation of the Trust, each of which could result in a reduction in the price of the Shares. Shareholders may be adversely affected by lack ninjatrader partners how to read stock charts on robinhood regular shareholder meetings and no voting rights. Consequently, there is a lack of financial incentive for developers to maintain or develop the Bitcoin Network and the Core Developers may lack the resources to adequately address emerging issues with the Bitcoin Network protocol. The Index Provider tradestation 10 modify icon where to invest in stock market online a monitoring system that tests for these criteria on an ongoing basis. How much to set up an ameritrade thinkorswim porn invest stock is accomplished by adjusting the weight of each input based on price deviation relative to the observable set of data for the relevant trading venue, as well as recent and long-term trading volume at each venue relative to the observable set for the heiken ashi smoothed indicator forex free trading system trading venues. The trust's popularity is to blame for its rather unpredictable performance. We may not sell these securities until the high market life forex trade call group statement filed with the Securities and Exchange Commission is effective. Each new block records outstanding bitcoin transactions, and outstanding transactions are settled and validated through such recording, the Blockchain represents a complete, transparent and unbroken history of all transactions on the Bitcoin Network. Miners soon discovered that graphic processing units GPUs provided them with more processing. If the award of new bitcoins for solving blocks declines and transaction fees are not sufficiently high, miners may not have an adequate incentive to continue mining and may cease their mining operations. Shareholders do not have the protections associated with ownership of shares in an investment company registered under the Investment Company Act or the protections afforded by the CEA. Each share currently represents ownership of approximately 0. The trust owns bitcoins on its investors' behalf, entrusting them to the cryptocurrency custody service Xapo to keep them safe. To measure volume data and trading halts, the Index Provider monitors trading activity and regards as eligible those Bitcoin Exchanges that it determines represent a substantial portion of. Bitcoin is a prominent, but not a unique part of this taxation of stock dividends bitcoin investment trust etf gbtc. By investing in the Shares, investors agree and consent to the provisions set forth in the Trust Agreement. Bryan Perry A former Wall Street financial advisor with three decades' experience, Bryan Perry focuses his efforts on high-yield income investing and quick-hitting options plays.

As a result, an intellectual property rights claim against the Trust could adversely affect an investment in the Shares. Using a composite. Please enter your information below to access: An Introduction to Ethereum Classic Please note Grayscale's Investment Vehicles are only available to accredited Investors. December 27, am. Therefore holders of Ethereum Classic were given an equal number of the new Ethereum currency and therefore held equal numbers of Ethereum Classic and Ethereum when the fork became permanent. Historically, the Trust has not needed to make any changes in the determination of principal market due to variances in pricing, although it has changed its principal market due to disruption of operations of the Bitcoin Exchange considered to be the principal market. The Shares are neither interests in nor obligations of the Sponsor or the Trustee. Investors are therefore cautioned against placing undue reliance on forward-looking statements. It would be an unfortunate thing to pay such a high price that you end up losing money on Bitcoin Investment Trust over a period in which bitcoin rises in value. The loss or destruction of a private key required to access a bitcoin may be irreversible. If a permanent fork, similar to Ethereum, were to occur to bitcoin, the Trust would hold equal amounts of the original and the new bitcoin as a result. Plan of Distribution. Miners ceasing operations would reduce the collective processing power on the Bitcoin Network, which would adversely affect the confirmation process for transactions i. Table of Contents U. To the extent that future regulatory actions or policies limit the ability to exchange bitcoins or utilize them for payments, the demand for bitcoins will be reduced and Authorized Participants may not seek to redeem Redemption Baskets in exchange for redemption proceeds in bitcoins.

BTC Trust in the News Are your clients primarily accredited investors? If an Authorized Participant or Liquidity Provider determines not to comply with such additional regulatory and registration requirements, an Authorized Participant or Liquidity Provider may terminate its role as an Authorized Participant or Liquidity Provider of the Trust. Banks may refuse to provide bank accounts and other banking services to bitcoin-related companies or companies that accept bitcoin for a number of reasons, such as perceived compliance risks or costs. Each share currently represents ownership of approximately 0. Although we are responsible for all disclosure contained in this prospectus, in some cases we have relied on certain market and industry data obtained from third-party sources that we believe to be reliable. Community-led efforts to merge the blockchains were not successful and a small minority of Ethereum holders continued to support the old blockchain. All documents will be posted here once finalized, so please check back in. Finance Home. Use of Proceeds. To the extent that bitcoins are deemed to fall within the definition of a security under U.